Modeling and Forecasting the Evolutionary Economic Development of the BRICS and G7 Countries in the First Half of the Twenty-First Century

Journal: Journal of Globalization Studies. Volume 15, Number 2 / November 2024

DOI: https://doi.org/10.30884/jogs/2024.02.01

Viktor A. Sadovnichiy, Lomonosov Moscow State University, Russia

Askar A. Akaev, Lomonosov Moscow State University, Russia

Olga I. Davydova, Lomonosov Moscow State University, Russia

The work describes the process of formation of the inter-civilizational association BRICS and its transition to a new stage of development in connection with the expansion to BRICS 11 at the 15th summit in Johannesburg (South Africa, August 2023). The association is expected to expand further by admitting a second wave of states that are waiting for their turn. BRICS+ is now becoming the basis of a new, successfully emerging, equitable multipolar world order, which is becoming a real alternative to the short-lived unipolar world order with the US hegemony, supported by the G7 countries. Today, the BRICS association has already reached parity with the G7. But in the future, the balance of power will increasingly shift in favor of BRICS+. It is shown that BRICS+ will have sufficient technological sovereignty, a dominant supply of natural resources and financial institutions to allow a sustainable association to develop successfully in a world currently divided on a bloc basis.

For the purpose of long-term modeling and forecasting of the economic development of the vanguard countries that are members of the BRICS+ and G7 associations, new models that adequately describe demographic dynamics and total factor productivity (TFP) have been selected, adapted, and partially developed. It is shown that a production function (PF) consisting of the above-mentioned two factors – demography and TFP – is sufficient for forecasting long-term economic growth. All models are verified using actual data on these factors for the period fr om 1950 to 2020 and show high approximation accuracy. The proposed models were used to calculate the projected trajectories of demographic dynamics, technological progress and economic growth of the BRICS+ and G7 vanguard countries. Their comparative analysis has been carried out, showing that in the context of the current geo-economic fragmentation of the world, the BRICS+ countries are able to develop autonomously and sustainably at a rapid pace and become the locomotive of world development, ensuring the sustainable development of the countries of the Global South. It is shown that by the middle of the twenty-first century, the share of the BRICS+ countries in the world economy is expected to reach 80 % and they will be home to about 2/3 of the world's population.

Keywords: inter-civilizational crisis; geo-economic fragmentation of the world; the role of the BRICS and G7 countries in the intercivilizational conflict; an era of instability and uncertainty in global economic development; unipolar and multipolar world order; dynamics of the balance of power between BRICS+ and G7; demographic dynamics; technological progress; total factor productivity; the economic growth; mathematical models; sustainable development; comparative analysis of the economic development of the BRICS and G7 countries.

The Establishment of the BRICS Association

in the Context of a Civilizational Crisis

Since the end of the twentieth century, the world has entered an era of historical rift, a long and deep global crisis caused by a change in ultra-long-term civilizational cycles – the decline of a two-hundred-year-old industrial civilization and the emergence of a humanistic-noospheric integral world civilization, the transition fr om a five-hundred-year-old fourth generation of local civilizations dominated by the West to the fifth generation – under the leadership of the East. One of the manifestations of the global crisis is the sharp aggravation of the geopolitical contradictions between the rising civilizations and leading powers led by China, India and Russia, which are laying the foundations of an integral civilization and a multipolar world order, and declining civilizations and world powers, led by the USA and the European Union, seeking to preserve the doomed world, removing industrial civilization fr om the historical stage and establishing a unipolar world order under Western hegemony (Yakovets 2021).

In this context, an urgent need arose to create a new world order, taking into account the changed balance of power, the shift of the center of civilizational activity to the East as a result of the strengthening of the positions of China and India, the formation of BRICS and the SCO on the initiative of China and Russia. The strategic documents of BRICS and SCO define the measures for creating a new world order. The strategy for establishing a sustainable multipolar world order is aimed at overcoming the growing gap between civilizations at the beginning of the twenty-first century, which threatens to develop into a suicidal clash of civilizations. The key issue is the problem of preventing a clash of civilizations and the looming danger of a new world war with the use of nuclear weapons and other means of mass destruction. No less dangerous is the unfolding hybrid war, in its new forms, the leading element of which is the information and ideological warfare. A new model of a multipolar world order should focus on dialogue and partnership among civilizations and leading powers in response to these and other global challenges of the twenty-first century. The prospects for the formation of a sustainable multipolar world order based on a partnership of civilizations and its scientific foundations have been outlined in the works of the Yalta Civilization Club (Yakovets and Akaev 2016; Sadovnichy et al. 2018).

Fr om the very beginning, the BRICS association was considered by its organizers as a center for crystallizing a new global multipolar world order, with the UN system playing the leading role. Each member of the organization, regardless of their own political weight and military power, has the right to express themselves and defend their position. Relations between states within the organization are exclusively democratic and equal. The practice of annual passing the chairmanship is a very effective tool in this regard. It is extremely important that the core BRICS countries (Brazil, Russia, India, China and South Africa) lay the foundations for a future integral economic and socio-cultural system to replace the now moribund financial capitalism. The main feature of the cluster of BRICS+ countries after the expansion in 2023 is that it is formed by countries belonging to eight different local civilizations out of twelve, occupying different geopolitical positions in the world, but, at the same time, united by the presence of extremely important common characteristics: all of them are large, dynamically developing states with large populations, interacting with the United States and other developed countries as independent subjects of the world economy and politics.

The focus on the BRICS+ countries is explained by their rapidly growing political role and economic weight in the modern world. In addition, they have a huge impact on neighboring countries and regions.

The BRICS, as a global geopolitical association primarily aimed at equal economic integration of member countries, is the most attractive format for developing countries today. First, it unites the leading countries with huge growing markets that can meet the demand for raw materials, components and finished goods in developing countries of the second and subsequent echelons. Secondly, trade with the BRICS countries can be conducted in the national currencies of the participating countries, which gives advantages to developing countries in the current environment of rising prices for such global currencies as the dollar and the euro. Thirdly, fair trade conditions without restrictions and sanctions. All this makes the BRICS association a powerful magnet attracting developing countries. Therefore, it is not surprising that recently there has been an explosive growth in the number of countries wishing to join BRICS. At the 15th summit of the union in Johannesburg (August 22–24, 2023), six of them were already accepted as BRICS+ members: Argentina, Egypt, Iran, Saudi Arabia and Ethiopia. BRICS+ now accounts for 37 % of global GDP in PPP terms, compared with 30.7 % for the G7 countries (BS Web Team 2023). The BRICS+ countries are home to 46 % of the world's population. Argentina has rejected the invitation to join BRICS+ under newly elected President Javier Milei, but this will not affect the expansion of BRICS in any way, since there are still many countries in line. Today there are more than 20 of them, of which more than ten countries have already officially submitted applications to become members of the association. Among them are countries such as Indonesia, Nigeria, and Turkey, which are leaders in their respective regions. All this suggests that BRICS+ is a growing geopolitical force.

Gradually, the BRICS countries turns fr om an informal international forum into an association of countries that begin to act together to strengthen their positions in the modern world, and, most importantly, to have a positive impact on the expanding processes of fair globalization and the formation of a new fair multipolar world. Since the majority of the BRICS+ member countries are members of the G20, which has already acquired the status of a permanent international body wh ere the most important issues of the world economy, sustainable development and global governance are resolved, the positions of the developing countries in the G20 will be greatly enhanced by the expansion of BRICS, which will contribute to the fair consideration and resolution of their problems at the global level. Through the decisions of the G20, the BRICS+ countries can 1) strengthen the mechanisms for regulation of the global financial market; 2) achieve fair international trade, and 3) effectively control and stabilize prices on the world food market, which are vital for poor developing countries.

The institutionalization of the BRICS association is also becoming more and more stable. Thus, in 2022, at the BRICS summit in China, a strategy for cooperation between the countries of the association in the field of food security was adopted, a Technology Transfer Network was created, and a Framework Agreement on Partnership in the Development of the Digital Economy was introduced (Ministry of Economic Development of Russia, 2022). In 2023, at the 15th anniversary summit in Johannesburg (South Africa), the association was expanded, criteria and procedures for admitting new members were formulated, and it was decided to recommend India and Brazil for inclusion in the UN Security Council (RBC 2023). Meanwhile, the second wave of countries is expected to join, there will be also established a permanent Commission for the development of logistics and transport corridors connecting the countries of the association, and a decision may be taken on the creation of a single settlement currency for the BRICS+ countries. Thus, BRICS becomes a platform for comprehensive cooperation in many areas, including trade, finance, agriculture, industry, as well as cultural and humanitarian exchanges. At the same time, BRICS has become a platform for uniting the developing countries of the Global South, promoting the transformation of global governance towards justice and rationality. Indeed, at the Johannesburg summit, Chinese President Xi Jinping said, ‘The BRICS Cooperation Mechanism, as an important cooperation platform for emerging market and developing countries, has become a constructive force in promoting global economic growth and improving global governance and promoting the democratization of international relations’ (South China Morning Post, 2023).

When the global financial and economic crisis, caused by the United States and its closest allies, broke out in 2008–2009, the G7 countries, convinced that its negative consequences could not be dealt with without large losses within the core of Western countries, convened an anti-crisis summit of the G20 (G20) with the participation of all the leading developing countries. The idea that it would be easier for the whole world to cope with the disaster was justified: the first G20 summits, held in Washington in November 2008 and in London in April 2009, were very effective and helped the G7 countries to cope with the consequences of the crisis with the least possible losses. All this even raised hopes of the possibility of implementing the idea of a world government based on the G20. Indeed, today the G20 countries account for about 90 % of the world's total GDP and they are home to about 2/3 of the world's population. Thus, the G20 acquired the status of a permanent body. However, as soon as the threat of the financial crisis began to weaken, the G20 countries turned fr om like-minded people into competitors. As the developing countries were initially more inferior to the G7 countries in terms of their economic potential, the G7 continued to impose their agenda on the G20. Today, however, the BRICS countries have almost reached approximate parity with the G7 countries: the former have surpassed them in economic potential and are on the rise, while the latter still have a financial, technological and military advantage, but are experiencing a permanent crisis and general decline.

The Role of BRICS and G7 in Global Development

BRICS is increasingly becoming a geopolitical alternative to the G7 group of developed countries led by the United States. With an undeniable advantage over the G7 in terms of population and labor resources, as well as in natural resource potential, BRICS has become the world leader in terms of economic growth rates, investment in fixed capital assets and the production of many types of high-tech products. Thirty years ago, in 1992, the share of the G7 countries in world GDP was about 46 %, while the share of the BRICS countries was only about 16 %. It is significant that already in 2022, the GDP of the BRICS countries in PPP exceeded the GDP of the G7 countries. The GDP share of the BRICS countries reached 31.5 % of world GDP, while that of the G7 countries dropped to 30.7 % (BS Web Team 2023). By 2028, it is predicted that the total volume of the BRICS economies will reach 35 % of world GDP. Moreover, it is predicted that this trend will continue in the current decade. As for the leading economies, today China already accounts for 18.9 % of the world economy, followed by the USA with 15.4 %, and India with 7.5 % (World Economics, 2023). China will play the main role in global economic growth over the next five years, accounting for 22.6 % of global GDP growth. China will be followed by India with 12.9 %, followed by the USA with 11.3 % (Tanzi 2023). These three countries will account for almost half of the global economic growth over the coming decade, with BRICS leaders, China and India, accounting for three-quarters of that growth.

Thus, while in the twentieth century the development of the world economy was determined by the Western countries led by the United States (G7), in the twenty-first century the leadership passes to the BRICS countries. It is important that the economic potential of the BRICS countries has been growing in recent years, largely due to an increase in trade turnover and mutual investments between members of the organization. As early as 2014, the BRICS created their New Development Bank and concluded the ‘Agreement on the BRICS Reserve Fund,’ which has similar functions to the World Bank and the IMF, which frees developing countries from the dictates of the G7 countries in the World Bank and the IMF. A positive step towards increasing the efficiency of economic cooperation between the BRICS countries will be the introduction of a single settlement currency, the idea of which has been incubated for a long time. Moreover, the share of national currencies in payments between the BRICS countries is already actively growing. In particular, China and India have in recent years been given priority access to Russia's cheap energy resources exclusively in national currencies. Thus, the BRICS countries form a multipolar world in both geopolitical and economic-financial terms.

What are the chances of the BRICS+ association becoming a driving force for the development of the world economy in the new sixth large Kondratieff wave (2020–2050)? Will the BRICS+ countries be able to use the basic technologies of the fourth industrial revolution – digital technologies and artificial intelligence technologies and create a competitive digital economy? Will the BRICS countries be able to maintain sustainable development in the long term by gradually reducing income inequality in society to a socially acceptable level? All these questions will be given positive answers in the future. Thus, BRICS is a solid foundation for the formation of a new, fair multipolar world order. Most of the developing countries that are now candidates to join the BRICS inter-civilizational association are leaders in their regions, worthy representatives of their respective local civilizations and build socially oriented states. They will be able to really enhance the economic potential and expand the geopolitical capabilities of BRICS. So, BRICS+ has every chance of becoming the locomotive of global development in the second quarter of the twenty-first century.

Before we begin to describe dynamic models for forecasting technological progress and economic growth of the BRICS+ and G7 countries, let us consider the current situation in the world economy and the long-term trends that have emerged recently – deglobalization and fragmentation of the world economy and dedollarization of the global financial system. Taking the latter into account is important for long-term socio-economic forecasting of the world's leading countries. The world economy today is characterized by the highest levels of uncertainty and instability. The instability of the world economy is due to the instability of the financial system of the developed countries of the world. It began in 2008 with a financial crisis in the most developed Western countries, which developed into an economic crisis with a deep recession. More recently, we have again observed financial instability in the United States and the European Union, as well as cases of banking crisis. The period of cheap money, which was printed in abundance by the most developed countries of the West, starting in 2008, lasted almost 15 years until the beginning of 2022, when it caused a surge in inflation almost everywhere in both developed and developing countries.

In order to curb out-of-control inflation and bring it down to target levels, the central banks of the world's leading countries immediately launched a cycle of monetary tightening policy (MP) through sharp, gradual increases in the key interest rate. However, despite the steady rise in interest rates over the past year and a half, inflation has remained stubbornly high at 6–8 % per year in most countries. The economies of the developed countries have practically entered a period of stagflation, since they are simultaneously stagnating at low growth rates. Stagflation is expected to continue for several more years. Recession is expected in a number of countries – the USA, Germany and others, – as a sharp credit contraction has begun. The average growth rate of the developed economies is expected to fall to a 70-year low of 1.2 % per year in the 2020s. The eurozone economy is currently in the most fragile state, vulnerable to loss of stability under the influence of small external and internal shocks. Such a shock, in particular, could be a further intensification of the energy crisis in the winter of 2023–2024. After the crisis of 2008–2009 and the subsequent depression of 2011–2017, the economy of the European Union was never able to emerge from stagnation.

On the contrary, the vanguard developing countries and, first of all, their leaders – China and India – survived the crisis of 2008–2009 with relative ease and continued to develop steadily. At the end of 2023, the growth rates of China remained high – 5.6 % (3 %), India – 6.3 % (7.2 %), Indonesia – 4.9 % (5.3 %), Egypt – 4 % (6.6 %) (IMF, July 2023). The actual growth rates for 2022 are shown in brackets. Favorable forecasts for economic growth rates in 2023 also include Russia – 2.1 %, Brazil – 2.9 %, Iran – 2.2 %, Saudi Arabia – 2.2 % and Nigeria – 2.8 % (IMF 2023). However, poor countries saddled with large debts that could undermine their financial stability face difficult prospects in the coming years. Firstly, the rise in the world currency prices caused by the tightening of monetary policy has led to a sharp increase in debt servicing cost. Secondly, there has been a fall in commodity prices, which has reduced these countries' export earnings. Thirdly, there has been an outflow of capital from these countries. UN Secretary-General Antonio Guterres said on July 18, 2023 that 52 developing countries are currently unable to meet their debt obligations, and a number of them are close to default (TASS 2023).

Consequences of the Conflict of Civilizations on Global Economic Development

The opposition between Western and Eastern civilizations that emerged at the beginning of the new millennium has recently taken on a confrontational character due to changes in long-term civilizational cycles. The United States has declared a cold war on China and imposed a proxy war on Russia in Ukraine, which is accompanied by a breakdown in cultural and humanitarian cooperation, the waging of trade and technological wars, and unilateral sanctions in almost all key areas of interaction. All this has led to the beginning of the deglobalization of the world economy, or ‘geo-economic fragmentation’ in the words of the IMF chief Kristadina Georgieva (Georgieva, Gopinath, and Pazarbasholu 2022). The IMF experts have even calculated that the fragmentation of the global economy could cost up to 3 % of global GDP over a 7–10 years horizon (Bolhuis, Chen, and Kett 2023). The largest declines are expected to occur in the least developed countries and will be in the double digits. Over the past 30 years, the world economy has developed in a paradigm of relatively advanced globalization, with beneficial effects on capital flows, production and supply chains, labor migration, and the spread of new technologies and ideas that have enriched both developed and developing countries. For example, free trade and globalization have enabled China and India to achieve unprecedented economic growth and lift hundreds of millions of their citizens out of poverty.

And now all this is collapsing for a long time. Moreover, the United States and developed Western countries are consciously moving towards deglobalization of markets, since in the first phase of globalization they were the main beneficiaries, and now a significant part of the benefits has started to flow to the developing countries. And this is not part of the plans of the collective West, even if some Western countries suffer serious losses. For example, the collapse of the single global energy market into macro-regional ones, achieved by the targeted actions of the United States and the European Union, has primarily affected the leading Western European countries. Forced to pay 3–5 times more for gas than before, they have lost their main economic advantage – they lost access to cheap Russian energy resources and are now plunging into long-term economic stagnation. The IMF predicts that the growth rate of the EU economy will fall from 3.7 % in 2022 to 0.7 % in 2023, after which it will recover at a very moderate pace for many years (IMF 2023). The European economic model is in danger of finally losing its main source of prosperity for decades, based on cheap Russian energy resources. The European Union has fallen victim to the fraudulent actions of the United States and is now buying LNG from the United States at exorbitant prices.

It is noteworthy that it was not Western leaders, but Chinese President Xi Jinping, who spoke as a defender of globalization and free trade at the World Economic Forum in Davos in 2017. He then called on all Forum participants to learn to manage globalization, mitigate its negative impacts, and use its beneficial ones for the prosperity of all peoples and countries. He called for building an open global economy to provide equal opportunities for everyone: ‘We must remain committed to the development of free trade and investment, we must say no to protectionism’ (BBC News Russian Service, 2017). The rise of protectionism in the United States and other Western countries, which began after the financial and economic crisis of 2008–2009 and has taken the form of restrictions on trade, finance and investment, could have a major negative impact, slowing down the process of globalization. Deglobalization could deal a powerful blow to the prospects for sustainable development of the global economy in both the short and long term. In the short term, rising protectionism will hurt trade, leading to a sharp decline in investment flows. And this in turn threatens to weaken demand and pose risks to the long-term development of the global economy.

Thus, in essence, the world is already fragmenting the global economy between actors belonging to opposing blocs. It is important to note that it was the United States that was the first to build a closed bloc of the countries of the ‘collective West,’ closing production and technological chains exclusively to its allies. Consequently, the rising countries and civilizations themselves need to support and develop the processes of fair globalization within the framework of the SCO and BRICS. Fortunately, China has been already implementing this within the framework of the SCO through the active implementation of the ‘One Belt, One Road’ megaproject over the past decade. All this is made easier by the fact that the world is already moving from a unipolar financial system based on the dollar to a multipolar one, with a growing share of developing countries' national currencies. Even the IMF has already admitted that the world is gradually moving away from the dollar as the sole reserve currency. Previously, the dollar accounted for about 70 % of reserves, but now this figure has already fallen to 58 % (Smirnova 2023).

Developing countries are increasingly moving towards mutual settlements in their local currencies. The role of the Chinese yuan in the global economy is increasing. Russia was the first to start abandoning the dollar about ten years ago, and has now accelerated this process, choosing the yuan as an alternative. For Russia, the yuan is now one of the main currencies in international reserves and payments. The Russian ruble is also increasing its share in the world economy due to the transition to domestic currency settlements with friendly countries. Brazil recently reached an agreement with China to conduct trade and financial transactions in their domestic currencies, eliminating the dollar as an intermediary currency. India is actively expanding the list of countries with which it trades in rupees, which now stands at around twenty. The main contribution to this process is still made by China, which in recent years has been buying more and more oil and LNG from Iran, Venezuela, Russia, Saudi Arabia and Africa in its own currency, the yuan. Thus, petrodollars are gradually giving way to petroyuan. Since China is the world's largest oil importer (about 15 % of global consumption), the petroyuan is increasingly becoming the preferred choice for international trade. Moreover, six of the nine countries – the world's largest oil exporters – are now members of BRICS+.

Continuing the process of globalization in a fair way within the framework of BRICS and the SCO is quite possible, as it is predicted that two-thirds of global demand will come from consumers from developing countries by 2050. Surely, most of them will end up in the SCO and BRICS by then. As a result, the BRICS countries will soon no longer be dependent on demand from the developed countries. Calculations show that it is the growth of the middle class in the BRICS countries and other developing countries that will be the defining trend in the global economy over the next 30 years. The main beneficiaries will be service companies, whose costs will rise as per capita income rises. At the same time, the fall in the savings rate and the growth in consumption in Asian countries, as well as in Latin America, will make it possible to solve the pressing problems of a multipolar economy and provide it with sufficient demand for dynamic development. Fifteen years ago, in 2008, the world's middle class numbered 1.8 billion people. Half of them lived in the developed Western countries (0.9 billion people) and a quarter (450 million people) lived in the BRICS countries. And today, in China alone, the middle class already numbers some 600 million people. Moreover, the Western middle class is rapidly melting and becoming poorer, it is already poorer than the Chinese and, for the first time in 200 years, risks not being among the 20 % of the world's richest people (Bashkatova 2023).

The question also arises whether the BRICS and SCO countries, which are building a new multipolar world order, will be able to master the key intellectual technologies of the new digital order. But, as a recent study by the Australian Strategic Policy Institute (ASP) has showed, China has already dramatically outperformed Western countries in the technological race (Gaida et al. 2023). Counting 44 new key technologies in defense, space, energy, biotechnology, AI, robotics and advanced smart materials, ASP argues that China is leading the race by a wide margin. Scientists from the Chinese Academy of Sciences were far ahead of their Western counterparts, including Americans, in working on 37 or 84 % of the key technologies. Moreover, Chinese scientists have made great strides thanks to their work under government programs. Today, China hosts seven out of the world's ten leading research institutes. China still lags behind the United States in one important area of semiconductor technology – the production of nanochips based on 7 nm, 5 nm, 3 nm and 2 nm processes. Such nanochips are today produced only in Taiwan using American technology, using Dutch lithography based on extreme ultraviolet light with a wavelength of 13.5 nm, and are controlled by the United States. China is currently trying to establish its own production of such nanochips, and has already developed an alternative, higher-performance lithography route with a wavelength of 13.5 nm and has already mastered the production of nanochips using the 7 nm process technology. There is confidence that in the near future China will be able to produce the full range of nanochips using the most advanced technologies and will take a leading position in the semiconductor industry.

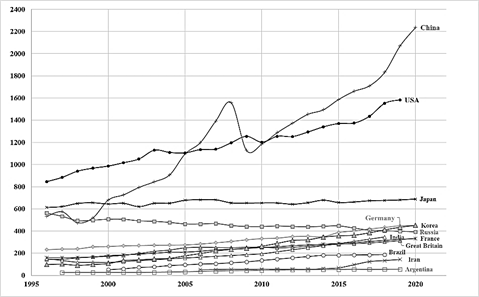

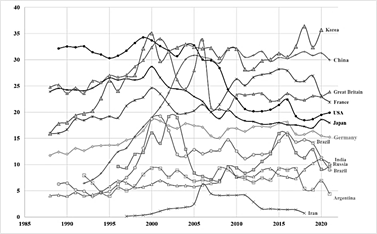

China has successfully industrialized its economy based on fifth-generation innovative technologies generated by the microelectronics revolution of the 1980s, which was the pinnacle of the third industrial revolution (1960–1980). To this end, from the 1980s to the 2010s, China borrowed Western technologies very fruitfully by actively attracting foreign direct investment. At the same time, China managed, in parallel, to create the world's largest and most efficient R&D system, which today employs about 1.8 million scientists and technical workers (compared to 1.4 million people in the USA, see Figure 1). Moreover, most of the borrowed technologies have gone through the process of development, adaptation and improvement through the R&D system, making it highly effective. While a quantitative leap – the quadrupling of the number of people in the Chinese R&D system – took place in a quarter of a century (1998–2023, see Figure 1), the qualitative leap took place in the last 15 years (2008–2023), when the country began to move from borrowing technologies to developing its own.

Fig. 1. The number of researchers involved in R&D, thousands of people

Source: compiled by the authors based on World Bank data.

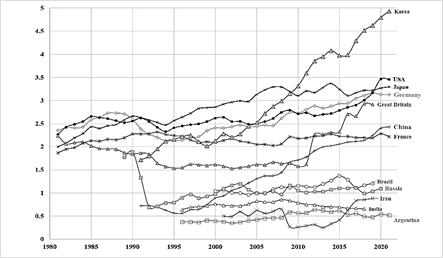

The volume of R&D funding in China has also quadrupled over the last quarter of a century (1998–2023) and today amounts to 2.5 % of GDP (see Figure 2), or about $456 billion in absolute terms. This is considerably less than in the United States (around $650 billion). However, due to its high efficiency, the Chinese R&D system quickly transforms technological developments into industrial innovations, as we can see from the innovative products of the Chinese company Huawei.

Fig. 2. The R&D expenditures (% of GDP)

Source: compiled by the authors based on World Bank data and (OECD Data, 2023).

Fig. 3. Share of manufacturing industry in value added

Source: compiled by the authors based on World Bank data.

Fig. 4. The share of manufacturing industry in total exports

Source: compiled by the authors based on World Bank data.

Today, China is close to achieving technological sovereignty, like no other power in history.

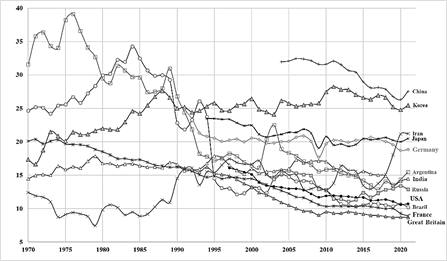

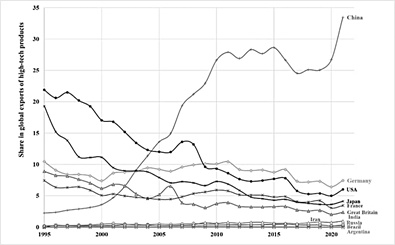

Indeed, as shown in Figures 3–5, since 2005, China has been ranked first in the world in terms of the share of production in value added (about 28 %) and total exports (about 93 %) and second in the share of high-tech industries in total exports (about 30 %) after South Korea. However, in terms of its share in world exports of high-tech products (more than 30 %), China is far ahead of all developed countries, whose share does not exceed 3–8 %, and advanced developing countries, whose share is 1–2 % (see Figure 6). However, the other leading BRICS member countries lag noticeably behind China. For example, the number of employees in the R&D systems of Russia and India is approximately 400 thousand people (4.5 times less than in the PRC), and in Brazil and Iran – about 180 thousand people (an order of magnitude less than in the PRC) (see Figure 1). The volume of funding for the R&D system in Brazil, Russia, Iran and India ranges from 1.4 % to 0.6 % of GDP (1.8 to 4 times less than in China, an order of magnitude).

Fig. 5. The share of high-tech industries in total exports

Source: World Bank, 2023.

Fig. 6. The shares of individual countries in global exports of high-tech products

Source: compiled by the authors based on World Bank data.

These indicators of the R&D system of individual countries are shown in aggregate form for all BRICS 11 and G7 countries for comparison purposes in Figures 7a and 7b. As can be seen from the graphs, the R&D systems of BRICS 11 are close to the R&D systems of the G7 countries (3.6 million people) in terms of the number of workers employed (3.1 million people, see Figure 7a). However, in terms of the funding of R&D systems, the G7 countries are three times larger than the BRICS 11, which implies both high wages for workers and their advantage in technical instrumentation. Therefore, it is quite natural that the BRICS 11 leaders, with the exception of China, are significantly behind the G7 countries in technological development (sovereignty).

Fig. 7. The shares of individual countries in global R&D

Source: Compiled by the authors based on World Bank data.

Let us illustrate this with examples of the performance of the leading BRICS 11 and G7 countries in the industrial sector.

1) Let us start with the share of the manufacturing industry in value added (see Figure 3). In India and Russia this share is about 14 %, in Brazil – 10 % (in China – 28 %).

It should be noted that Iran, despite the most severe sanctions imposed by the G7 countries, has managed to increase this indicator from 15 % before 2015 to 20 %, which shows the successful implementation of import substitution over the past 30 years (see Figure 3). Among the G7 countries, Japan and Germany lead in this indicator (about 20 %), while the USA, France, and the UK lag far behind – about 10 %, which indicates a significant degree of deindustrialization of these countries over the past 30–40 years.

2) Let us consider the share of the manufacturing industry in total exports (see Figure 4). The G7 leaders in this indicator are not far behind China (about 93 %): Japan and Germany – about 85 %, France – about 75 % and the USA – about 60 %. The BRICS 11 leaders, on the contrary, lag far behind on this indicator: Brazil, Russia and Iran – at the level of 20 %. Only India is in the leading group with an indicator of 70 %.

3) By the share of high-tech industries in total exports (see Figure 5), the BRICS 11 leaders are also far behind China (about 30 %): India, Russia and Brazil – about 10 %. Among the G7 countries, the UK and France are the leaders with about 23 %, followed by the USA, Japan and Germany with about 15 %. As we can see, the leader of the BRICS+ association still needs to work hard and fruitfully to master modern high-tech production and compete confidently with the G7 countries. In this regard, the BRICS+ countries look to their technological leader, China, with hope, especially since BRICS has already established a mechanism for the transfer of advanced technologies and introduced a Framework Agreement on Partnership in the Development of the Digital Economy.

The 15th anniversary BRICS summit in Johannesburg was a great success: it showed that the association has already moved beyond the formation stage, as it expanded to eleven countries for the first time. BRICS+ can count on even greater resources, as more than 20 countries are in the process of joining. Thus, BRICS+ has acquired additional weight in the world, its influence on international processes will increase and the collective West will have to reckon with it in the future. The BRICS+ is increasingly becoming a geopolitical alternative to the G7 and is transforming into a successful model of a multipolar and fair world order. The geopolitical and geo-economic vectors of BRICS+ are aimed at uniting the developing countries of the Global South. Russia and China, as the initiators of the BRICS association, strive to establish within its framework political equality, balanced and mutually beneficial trade and economic cooperation without sanctions and restrictions, as well as a fair architecture of global governance. South African President Cyril Ramaphosa has aptly said that ‘BRICS is an equal partnership of countries that have differing views but a shared vision for a better world’ (GIS Reports, 2023). Indeed, the overall goal of BRICS is to achieve sustainable human development under the auspices of the UN.

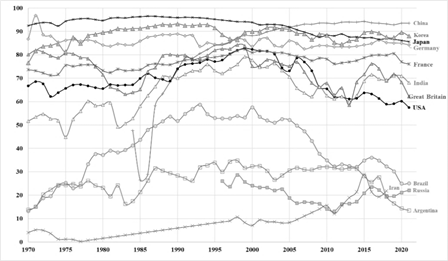

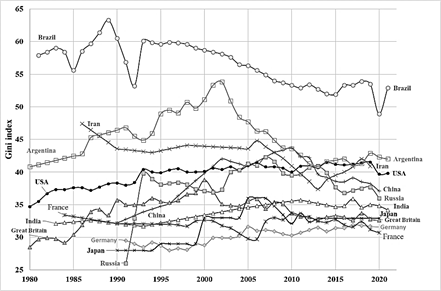

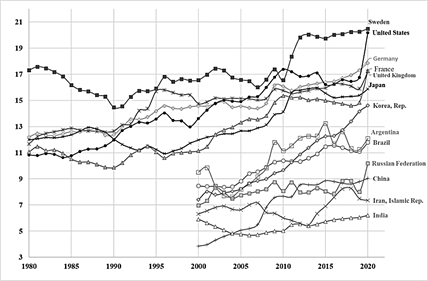

The BRICS+ countries are committed to respecting the sovereignty and independence of their partners and to recognizing the right of each people to its own development model. At the same time, BRICS+ does not intend to confront the collective West through confrontation and conflicts. The BRICS+ countries only want to get rid of Western dictates in international relations and internal affairs and to be guided by their own national interests, improving the well-being of their people. Indeed, there has been a clear downward trend in income inequality in the BRICS countries over the past decade (see Figure 8). This trend has been observed in Russia, China and India for the last ten years and in Brazil for 30 years. Today, the income inequality index in India, China and Russia is lower than in the United States and, if the trend continues, in five years it will be equal to the corresponding indicators in Japan, the United Kingdom and Germany (see Figure 8). On the other hand, in the leading BRICS 11 countries – Russia, China, India and Brazil – there is also a growing trend in investment in human capital (see Figure 9). And this will ensure the maintenance of social stability and the provision of basic social services that can support a long-term economic growth.

So, BRICS+ is on the rise. But it will have to overcome major difficulties created by the collective West. The United States, defending its dominant position in the world, takes an extremely conservative stance, not giving way to positive changes in international politics. Deglobalization will continue because true globalization no longer serves Western interests. Geo-economic fragmentation will also deepen as a result of the West's efforts, and the world is likely to be divided into rival economic blocs. But BRICS+ already has the potential to be sufficiently competitive in a divided world. BRICS+ will ensure the process of transition from a unipolar world order with US hegemony to a multipolar, fair world order. The West will no longer be able to stop the dynamic development and expansion of BRICS+. But this transition period will last at least a decade and will be accompanied by turbulent instability. During this transition period, the balance of power will gradually shift more and more in favor of BRICS+. And only by the mid-2030s, thanks to the constructive leadership of BRICS+, humanity will enter the era of sustainable development. And equality in interstate relations, mutually beneficial trade and economic cooperation without sanctions and restrictions, and fair global governance will become the basis of a new international law.

Fig. 8. Dynamics of income inequality in different countries of the world

Source: compiled by the authors based on World Bank data.

Fig. 9. Dynamics of investments in human capital

Source: Our World in Data, 2023.

Model for Calculating and Forecasting Economic Dynamics (GDP)

The Mankiw–Romer–Weil model with Harrod-neutral technical progress (Mankiw, Romer, and Weil 1992) is most widely used model for calculating and forecasting the economic dynamics of different countries,

.png)

where Y(t) is the current volume of national output (GDP); К(t) is the current volume of physical (production) capital; Н(t) is human capital; L(t) is the number of people employed in the economy (labor costs); А(t) is technical progress (total factor productivity); a and b are constant parameters, with a > 0, b > 0 and a + b < 1. We have verified the model basing on very extensive empirical data for more than 120 countries, and our analysis has shown that it describes very satisfactorily the dynamics of economic growth in both developed and developing countries, as well as the differences in the nature of growth between developing and developed countries. It is the high rate of accumulation of both physical and human capital that largely explains the rapid economic growth in the countries of Southeast Asia in recent decades.

Since we are interested in long-term trend forecasting of economic dynamics, we can simplify the Mankiw-Romer-Weil model (1) using empirical regularities (stylized facts) of Kaldor (Kaldor 1961), one of which is the statement that ‘the ratio of physical capital to output in the long run is almost constant’, i.e.

.png)

The French economist Thomas Piketty, in his famous book ‘Capital in the 21st Century’ (Piketty 2015), convincingly showed that the empirical pattern (2) persists in the 21st century, at least in its first half. Given that the process of human capital accumulation Н(t) is assumed to be similar to the process of physical capital accumulation (Mankiw, Romer, and Weil 1992), it can also be assumed that

.png)

Indeed, as shown in (Akaev 2019: § 1.5.1), this pattern is also confirmed by empirical data for developed and developing countries. The actual use of relations (2) and (3) in model (1) means accepting the assumption of constant returns to physical and human capital. Finally, the number of persons employed in the economy L(t) is related to the total population of the country N(t) as follows:

.png)

where сL(t) is a function that depends mainly on the aging population and the replacement of jobs by intelligent robots and computers. In this paper, we will accept сL(t) = const, assuming that full employment of labor resources will be ensured by reducing the working hours and other mechanisms.

If we now substitute relations (2)–(4) into the original model (1), we obtain a simplified version of the model:

.png)

The AN-model obtained in this way is better suited to long-term forecasting calculations, since it is based on two main order parameters that determine economic dynamics – technological progress А(t) and demographic dynamics N(t). And the latter can be predicted with great accuracy for many decades in advance. In particular, the model we developed is best suited for long-term forecasting of demographic dynamics (Akaev, Sadovnichiy 2010), which takes into account both the stimulating role of technological progress and the limiting role of the environment:

.png)

where К(t) is the current capacity of the habitat; Nc is the stationary population size, determined by the holding capacity of the habitat; N0 = 1 billion people, determined by the allowable lim it of natural bioconsumption; t1 is an average time for the onset of reproductive capacity (≈ 25 years); t2 is a time for the diffusion of basic technologies (≈ 25–30 years); t3 is a delay in the response of the Earth's biosphere to anthropogenic load (≈ 100 years); c and are constant parameters, r is the calibration coefficient. As we can see, the model is a non-linear differential equation with three delays – t1, t2 and t3. The methodology of modeling and forecasting demographic dynamics using model (6) is discussed in detail in (Akaev, Sadovnichiy and Anufriev 2011).

The model of demographic transition at the global level was first developed by the outstanding Russian scientist Sergey P. Kapitsa (2008):

.png)

where t is a regularizing parameter characterizing the active life expectancy of a person; С1 and Т1 are constants. This equation has a simple and elegant solution, which is commonly known as the ‘Kapitsa formula’:

.png)

Here is the Kapitza number. Using the data of the world demographic statistics, Sergey P. Kapitsa calculated the numerical values of the constant parameters of formula (8): С1 = 163 * 109; К = 60100; t = 45 years; Т1 = 1995. It follows that the global demographic transition began around 1950 (Т1 – t) and will end in the 2040s (Т1 + x). With these parameter values, it also follows from formula (8) that the Earth's population at t ® ¥ asymptotically tends to Nmax = pК2 » 11.36 billion people. Kapitsa's formula (8) and equation (7) describe the evolutionary regime of world population growth with stabilization and are valid only in the case of sustainable development of humanity, assuming an unlimited carrying capacity of the Earth's biosphere (Kapitsa 2008). Therefore, the Kapitza model (8) describes the upper lim it of the growth of the Earth's population, which can never exceed Nmax = 11.36 billion people. It has been shown that the Kapitsa model (8) perfectly approximates the growth of the Earth's population throughout the existence of human civilization and, especially during the period of demographic transition (Kapitsa 2008). The Kapitsa model can be successfully used to calculate the upper lim it of the demographic dynamics of individual countries that are able to ensure sustainable population growth without external migration.

Let us consider models describing technological progress (TP) А(t). At different stages of technological development, TP is described by different models (Akaev 2019: chapter 2). At the initial stage of the industrial revolution in the eighteenth–nineteenth centuries, the development of innovative technologies and products was carried out exclusively by individual inventors. At this stage of technological development, the TP is very well described by the Kuznets-Kremer model (Akaev 2019: § 2.1):

.png)

The rate of technological progress is therefore proportional to the rate of population growth. The Kuznets-Kremer model works at all stages of technological development because there are always individual inventors who make their own contribution to technological development. In the twentieth century, especially in its second half, when scientific and technological progress (STP) became the main element of public policy in the world's leading countries, TP began to be largely determined by the R&D efforts of governments. R&D has become a factory for the production of innovation. The results of R&D depend directly on the number of scientists, engineers and technical workers working in the system and the amount of funding for each workplace. In a modern economy, R&D expenditures are an integral part of the production process. Countries with powerful R&D systems tend to be technological and, therefore, economic leaders. It is R&D that helps lagging countries to catch up quickly with advanced countries.

The most effective model describing the contribution of the R&D system to technological development was developed in (Akaev, Sadovnichiy and Anufriev 2011):

.png)

where .png) are the technological growth rates achieved by indigenous technologies developed in the domestic R&D system; qА0 is a TP rate determined by the Kuznets-Kremer factor (9); is the calibration constant; lА0 is the share of persons employed in the R&D system at the initial time t = Т0; lМ is the maximum share of workers that can be employed in the R&D system; lА(t) is the current share of workers employed in R&D, and it grows according to the logistic law:

are the technological growth rates achieved by indigenous technologies developed in the domestic R&D system; qА0 is a TP rate determined by the Kuznets-Kremer factor (9); is the calibration constant; lА0 is the share of persons employed in the R&D system at the initial time t = Т0; lМ is the maximum share of workers that can be employed in the R&D system; lА(t) is the current share of workers employed in R&D, and it grows according to the logistic law:

.png)

Here LА(t) is the number of scientists and engineers employed in the R&D system; L(t) is the number of all employees in the economy; l1 and are constant parameters, and lА0(1 + l1) = lМ. The parameters l1 and are estimated using the least squares method (LSM). An important role is played by the choice of the point Т0 – the beginning of the real connection of the R&D system to accelerate the pace of the technological process qА(t). In the developed Western countries this happened in the 1920s, and in the vanguard developing countries – in the 1960s and 1970s.

Technological progress А(t) in the information-digital era (1980–2020–2050) should, of course, depend on the dynamics of the production of technological information ST. In (Akaev, Sadovnichiy 2018) we have shown that

.png)

where is the savings rate; .png) is capital productivity;

is capital productivity; .png) ; Iк is investments in fixed capital;

; Iк is investments in fixed capital;.png) ;

; .png) As is known,

As is known, .png) (Dolgonosov 2009). This directly follows:

(Dolgonosov 2009). This directly follows:

.png)

Where Tf is the year in which the information age began (Tf = 1950). Consequently, formula (12) for calculating the rate of technological change in the information-digital era is written as:

.png)

The main model of economic dynamics (5) contains the TP trajectory itself А(t), which can be recovered using the TP rate (14):

.png)

The model (12) for calculating TP rates was validated for the information era (1982–2018) and showed high accuracy in approximating the trend trajectory of TP growth rates (Akaev, Sadovnichiy 2018). Therefore, in its final form (14), it can be used to predict TP in the digital era (2018–2050).

Above, we have examined the endogenous sources of TP acceleration and the models describing them – (9), (10) and (14). But there is also an exogenous source – borrowing technologies from leading countries. Technological leaders are the first to move through all stages of technological development and to refine General Purpose Technologies (GPTs) that other countries can use to accelerate their economic growth. But not every country succeeds in this. For example, China has been the most successful and highly effective borrowing of GPTs from Western developed countries over the past 40 years (1985–2015). The model for calculating the contribution of borrowed technologies to the pace of technological development can be written as follows (Akaev 2019: § 2.6):

.png)

Here, .png) is the own TP rates of a developing country

is the own TP rates of a developing country .png) ;

; .png) is the borrowed TP rate of a developing country;

is the borrowed TP rate of a developing country; .png) is the own TP rate of a highly developed country (HI); 1(t – TB) is a unit function denoting the stage of GPT borrowing with the initial time t = TB, equal to 1 for t ≥ TB and 0 for t < TB; TLI is the time lag in the use of borrowed GPTs in a developing country;

is the own TP rate of a highly developed country (HI); 1(t – TB) is a unit function denoting the stage of GPT borrowing with the initial time t = TB, equal to 1 for t ≥ TB and 0 for t < TB; TLI is the time lag in the use of borrowed GPTs in a developing country; .png) is a constant coefficient indicating the efficiency of borrowing. Often, the contribution of borrowed GPTs to the rate of TP in developing countries significantly exceeds the rate of TP generated by their own technologies and innovations. Therefore, successful borrowing of GPTs is an important source of accelerated economic growth in developing countries.

is a constant coefficient indicating the efficiency of borrowing. Often, the contribution of borrowed GPTs to the rate of TP in developing countries significantly exceeds the rate of TP generated by their own technologies and innovations. Therefore, successful borrowing of GPTs is an important source of accelerated economic growth in developing countries.

Since in the general case the substitution of one innovative product by another takes place according to the logistic law (Fisher and Pry 1971) and also decays according to the reverse logistic law, the borrowing formula (16) in its final form takes the form:

.png)

Here, 1(TF – t) is a unit function equal to 1 for t ≤ TF and 0 for t ≥ TF; TB is the time of transition to borrowed technologies in a highly developed country (HI); TF is the start of the winding down of technology borrowing; .png) is the parameter that determines the life cycle duration of borrowed technologies (products) TD. By truncating the tail of the logistic function at the 0.05 level, we obtain the following formula for determining the parameter

is the parameter that determines the life cycle duration of borrowed technologies (products) TD. By truncating the tail of the logistic function at the 0.05 level, we obtain the following formula for determining the parameter .png) :

:

.png)

Modeling and Forecasting the Demographic Dynamics, Technological Progress and Economic Growth of the BRICS+ Countries

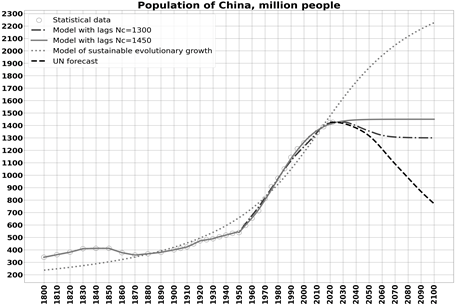

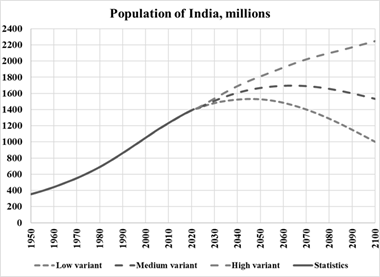

We will consider the post-war period, which spans a century (1950–2050) with a forecast horizon of about a quarter of a century (2024–2050), based on a 75-year history of development. The United States can be considered the undisputed technological leader of the world during this period, although for the first 30–40 years, the USSR and Japan were close behind, and today China is the top tech power. It is possible that in the 2030s, China will become the sole technological leader of the world. Today, China is the undisputed technological and economic leader in the BRICS 11 association. So let us start by considering China's development prospects and, first of all, we will use our model (6) to make a forecast of China's population dynamics up to 2100. The forecast trajectory of demographic dynamics is represented by a dashed line in Figure 10a. As we can see, China's population peaked at 1,412,600,000 people in 2021 and has since declined to 1,411,750,000 people by the beginning of 2023. Our forecast shows that the population will decline gradually until the 2070s, when it will stabilize at 1.3 billion, that is, over the next 50 years, about 110 million people will be lost.

a)

b)

Fig. 10. China Population Forecast

The forecast, created using the Kapitsa model (8), is presented as a point trajectory, indicating the upper possible lim it. The solid line in Figure 10a shows the trajectory of reaching a stationary level of 1.45 billion people without population decline, which is unlikely to be realized. Additionally, the dotted line in Figure 10a shows the average UN forecast, which projects a rapid population decline in China, so that by the end of the century it will drop to about 800 million people and potentially reaching zero by the twenty-second century. It is evident that this is an unrealistic and, most likely, overly alarmist projection. Figure 10b shows all three scenarios for China's demographic dynamics in the twenty-first century, as compiled by the UN staff, and all three show the disappearance of the Chinese civilization by the end of the twenty-second century and do not allow the stabilization of its population. Our model (6) shows that thanks to dynamic technological progress and economic growth, and the social project associated with the construction of democratic socialism with Chinese characteristics, China will be able to stabilize its population at a fairly high level, equal to 1.3 billion people by the end of the century.

Let us move on to describing and forecasting China's TP. In the 1950s, China borrowed industrial technologies from the USSR, but already in the early 1960s it began to restrict them. Since the 1980s, China has also been very successful in borrowing information technologies from the United States, Japan and the European Union, but mainly from the United States. This second wave of Chinese technology borrowing lasted until the crisis of 2008–2009, and then began to wane as a result of the US trade and technology wars against China. Both the first and second waves of technology borrowing gave a powerful impetus to the industrialization of the Chinese economy. At the same time, China has built the largest R&D system in the world today, employing some 1.8 million scientists and engineers (compared to only 1.4 million in the US), and which already fully provides the Chinese economy with its own developments, technologies and innovations. All this can be written in the form of the following model for calculating TP rates:

.png)

The first term with the coefficient .png) in this formula (19) is the Kuznets-Kremer formula (9), which determines the contribution of individual innovators to the overall pace of technological development. The second term with the coefficient

in this formula (19) is the Kuznets-Kremer formula (9), which determines the contribution of individual innovators to the overall pace of technological development. The second term with the coefficient .png) represents the contribution of industrial technologies borrowed from the USSR, starting from the 1950s, with virtually no time lag (ТLI = 0) in formula (17), since it was carried out directly by Soviet scientists and engineers. But the waning of the process of borrowing Soviet technologies began in 1960, so we take

represents the contribution of industrial technologies borrowed from the USSR, starting from the 1950s, with virtually no time lag (ТLI = 0) in formula (17), since it was carried out directly by Soviet scientists and engineers. But the waning of the process of borrowing Soviet technologies began in 1960, so we take .png) . It is known that the impact of this first wave of borrowing on the Chinese economy did not cease until the early 1990s, so in formula (18) to calculate the parameter

. It is known that the impact of this first wave of borrowing on the Chinese economy did not cease until the early 1990s, so in formula (18) to calculate the parameter .png) we assume TD = 30. The third term with the coefficient

we assume TD = 30. The third term with the coefficient .png) represents the contribution of technological borrowing in the United States (USA), which began in the 1980s, that is,

represents the contribution of technological borrowing in the United States (USA), which began in the 1980s, that is, .png) and ended in 2010. Therefore,

and ended in 2010. Therefore, .png) and the attenuation of its effect will occur by 2030, so TD = 20 years, from here, using formula (18), we obtain the specific value of the parameter

and the attenuation of its effect will occur by 2030, so TD = 20 years, from here, using formula (18), we obtain the specific value of the parameter .png) . The fourth term with the coefficient

. The fourth term with the coefficient .png) represents the contribution of indigenous technologies and innovations developed in the Chinese R&D system. The fifth term with the coefficient

represents the contribution of indigenous technologies and innovations developed in the Chinese R&D system. The fifth term with the coefficient .png) represents information and digital technologies, calculated by formula (14), multiplied by a logistic curve that increases equally for all countries throughout the information and digital era (1982–2050). Since TSB = 1982, TD = 60 years, it is assumed that the logistic function reaches saturation in 2042, then

represents information and digital technologies, calculated by formula (14), multiplied by a logistic curve that increases equally for all countries throughout the information and digital era (1982–2050). Since TSB = 1982, TD = 60 years, it is assumed that the logistic function reaches saturation in 2042, then .png) according to formula (18). Here it is taken into account that digital technologies, which laid the foundation for the sixth long wave of digital economic development in 2018 (Akaev, Sadovnichiy 2018), will reach saturation in 24 years in 2042. It also shows that technological progress in the information and digital age follows the law of logistics.

according to formula (18). Here it is taken into account that digital technologies, which laid the foundation for the sixth long wave of digital economic development in 2018 (Akaev, Sadovnichiy 2018), will reach saturation in 24 years in 2042. It also shows that technological progress in the information and digital age follows the law of logistics.

Model (19) contains all the important components of the dynamics of the rate of technological change in the Chinese economy, starting from 1950, and including the main forecast terms – the fourth and fifth, which describe the contribution mainly of China's own developments, technologies and innovations, starting from the 2000s. In order to calculate the TP rates using this model, it is first necessary to estimate the calibration coefficients .png) using actual data on TP rates for the whole retrospective period 1950–2020. Estimates of the calibration coefficients were obtained using the least squares method and yielded the following results:

using actual data on TP rates for the whole retrospective period 1950–2020. Estimates of the calibration coefficients were obtained using the least squares method and yielded the following results:

.png)

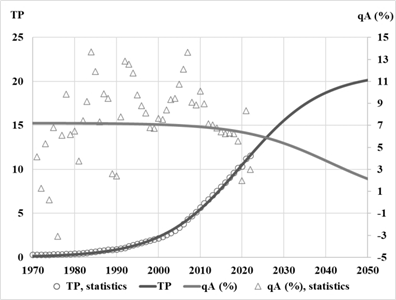

The trend curve describing the pace of technological change in the Chinese economy with a forecast to 2050, calculated using formula (19), is shown in Figure 11a. The trajectory of the TP, calculated using formula (15), is also shown there. With the calculated trajectories ACH(t) and NCH(t) (see Figure 10a), we use the formula (of the production function) (5) to calculate the trend trajectory of China's GDP growth YCH(t) with a forecast to 2050, having previously estimated the value of the calibration coefficient .png) using LSM. It is shown in Figure 11b. There is also a trend curve of economic growth rates qY(t), which shows a smooth decline in growth rates, characteristic of a technological and economic leader. In fact, according to our forecast, China's GDP will reach $49.3 trillion in 2050, while the US GDP will reach only $30 trillion by 2050.

using LSM. It is shown in Figure 11b. There is also a trend curve of economic growth rates qY(t), which shows a smooth decline in growth rates, characteristic of a technological and economic leader. In fact, according to our forecast, China's GDP will reach $49.3 trillion in 2050, while the US GDP will reach only $30 trillion by 2050.

a)

b)

Fig. 11. Trajectories of technological progress (a) and economic growth (b)

of China with a forecast to 2050

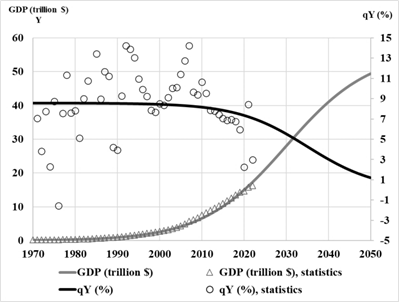

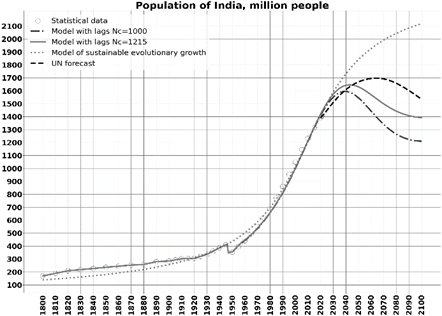

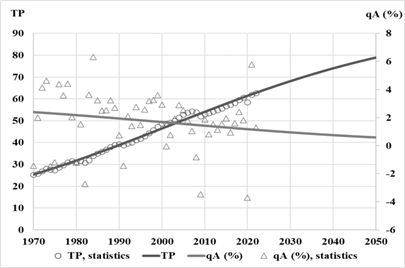

Similar to model (19) for China, models are built to calculate TP rates for other BRICS 11 countries – India, Brazil, South Africa, etc. Figures 12 and 13 show the projected trajectories of India's demographic dynamics (Figure 12), technological progress (Figure 13a) and economic growth (Figure 13b), calculated using the respective models. The projected trajectories of India's demographic dynamics, calculated using our model (6), show that India's population, after reaching a maximum of more than 1.6 billion people in the 2040s, will then decline and stabilize at a level between 1.2 and 1.4 billion people by the end of the century.

a)

b)

Fig. 12. India Population Forecast

a)

b)

Fig. 13. Trajectories of technological progress (a) and economic growth (b)

of India with projections to 2050

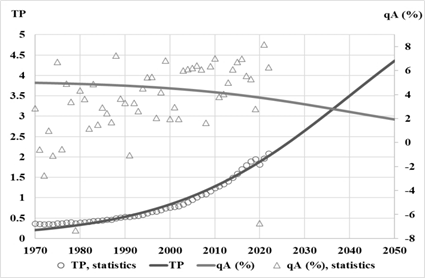

As can be seen from an examination of Figure 12b, which presents the UN forecasts, in the twenty-first to twenty-second centuries, India's population either goes to infinity (in the upper scenario) or declines permanently (in the middle and lower scenarios) until the Indian nation disappears. Obviously, all these scenarios are untenable. It is said that the UN forecasts do not take into account either environmental constraints or the stimulating role of TP and economic growth. As can be seen from the graphs in Figure 13, both the rate of TP and the rate of India's economic growth remain at high levels in the 2020s and 2030s, so India will continue to lead global economic development for a long time. By 2050, India's GDP will reach $26 trillion, almost as large as that of the US ($30 trillion). Thus, by the middle of the century, the three leading economies – China, the USA and India – will be well ahead of the rest of the world.

Russia in the BRICS association requires a special approach, as it has practically lost the civil industry created in the Soviet era, and started to build a new industry only in the 2010s. The borrowing of technologies from Western countries has long been closed to Russia. Therefore, in order to create a new digitalized industry 4.0, Russia will have to expand and modernize its R&D system, which today does not meet its needs. In fact, in 1991, during the collapse of the USSR in the Russian Federation (RF), more than 1 million scientists and engineers worked in the R&D system, and by 2020 their number had decreased to 400,000 people (see Figure 1). To create a new industry, Russia will need to create a new R&D system to supplement the old current R&D system, bringing the total number of people working in the R&D system to at least 600,000 people (Akaev, Sadovnichiy 2023: § 15.3). For comparison, Japan, which world along with China and the United States is one of the world's technological leaders, employs about 700,000 people in its R&D system (see Figure 1). Thus, for Russia it makes sense to consider the short period after the global financial and economic crisis of 2008–2009, that is, starting from 2010, when a new R&D system began to take shape in addition to the current one, on the assumption that by 2030 the number of people working in the R&D system will increase from the current 400,000 to 600,000. Of course, it would be optimal for Russia to double this number to 800,000 people, which would allow it to join the top three technological leaders along with China and the United States.

Taking into account the above considerations, we can create the following forecasting model for calculating the pace of technological change in the Russian economy:

.png)

The first term in this formula (20) with the coefficient .png) represents the contribution of individual innovators, determined by the Kuznets-Kremer formula (9). The second term with the coefficient

represents the contribution of individual innovators, determined by the Kuznets-Kremer formula (9). The second term with the coefficient .png) is the contribution of technologies and innovations developed in the expanding Russian R&D system, wh ere we take T0 = 2010 as the initial reference point. Furthermore, when calculating

is the contribution of technologies and innovations developed in the expanding Russian R&D system, wh ere we take T0 = 2010 as the initial reference point. Furthermore, when calculating .png) using the formula (11) we assume that

using the formula (11) we assume that ![]() people in 2010 will increase to

people in 2010 will increase to ![]() people by 2030, i.e. by 1.5 times. The third term with the coefficient

people by 2030, i.e. by 1.5 times. The third term with the coefficient .png) represents the contribution of information and digital technologies, starting from T0 = 2010 according to model (14), and the parameters TF, CSB, ϑSB and TSB are the same as in model (19) for China: TF = 1950, CSB = 19, ϑSB = 0.0982, and TSB = 1982. When calculating

represents the contribution of information and digital technologies, starting from T0 = 2010 according to model (14), and the parameters TF, CSB, ϑSB and TSB are the same as in model (19) for China: TF = 1950, CSB = 19, ϑSB = 0.0982, and TSB = 1982. When calculating .png) in the period from Tf = 1950 to 1991 (year of the collapse of the USSR) as NRF(t), we took the population of the Russian Federation as part of the USSR.

in the period from Tf = 1950 to 1991 (year of the collapse of the USSR) as NRF(t), we took the population of the Russian Federation as part of the USSR.

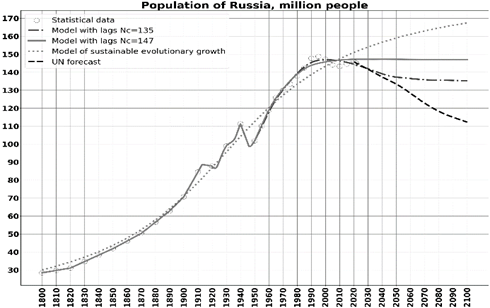

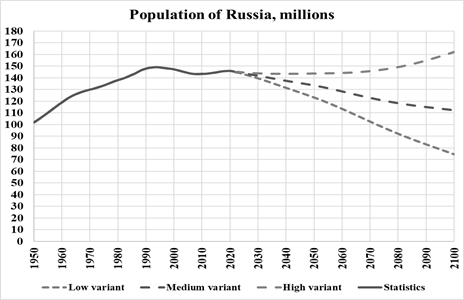

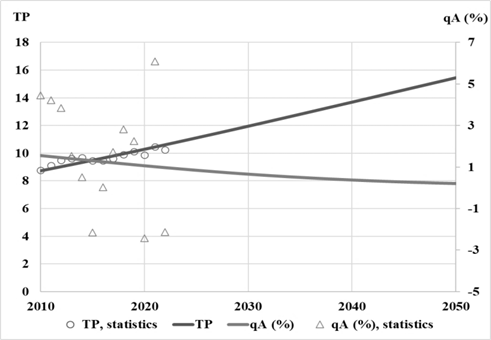

The demographic projections for Russia are presented in Figure 14. The predicted trajectories of demographic dynamics calculated using our model (10) show that Russia will be able to stabilize the population at a level between 135 (dash-dotted line) and 147 (solid line) million people (Figure 14a), while the average UN projection assumes a significant decline in the population of Russia – up to 110 million people. The range of different scenarios of the UN forecast (Figure 14b) – from continuous unlimited growth (upper scenario) to catastrophic decline (lower scenario) up to the disappearance of the Russian nation in the twenty-second century, speaks for its inconsistency. The average scenario of the UN forecast (see Figure 14b) allows for a stabilization of the Russian population in the twenty-second century, but at a low level, not exceeding 110 million people, which is unacceptable for Russia. The rates of technological progress calculated using model (20) are shown in Figure 15a. As we can see, they are low compared to similar indicators for the leading countries – China (see Figure 11a) and India (see Figure 13a). The projected trajectory of Russian GDP dynamics, calculated using model (5), is presented in Figure 15b. The GDP volumes achieved by Russia are very modest for a great power. To significantly accelerate Russia's economic growth, a more active expansion of R&D to 800,000 people by 2030 and a revolutionary achievement of technological sovereignty, as was achieved in the USSR in the middle of the last century, are necessary.

a)

b)

Fig. 14. Forecast of the population of Russia

a)

b)

Fig. 15. Trajectories of technological progress (a) and economic growth (b)

in Russia with a forecast to 2050

Modeling and Forecasting the Development Dynamics of the G7 Countries

The technological and economic leader of the G7 countries is the United States. As the technological leader of the world in the second half of the twentieth century and the first two decades of the twenty-first century, the United States, paved the way for technological progress and it practically does not borrow technologies from other countries. Therefore, the modeling and forecasting of TP in the US economy is carried out according to formulae (9), (10) and (14). So we write the model for calculating and forecasting the rate of technological change in the US economy in the following way:

.png)

Here, as before in other models, TF = 1950, CSB = 19, ϑSB = 0.0982, and TSB = 1982.

The calibration coefficients are estimated with LSM and have the following meanings:

.png)

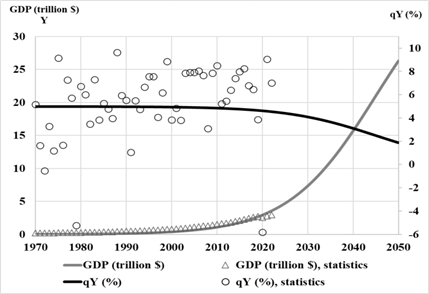

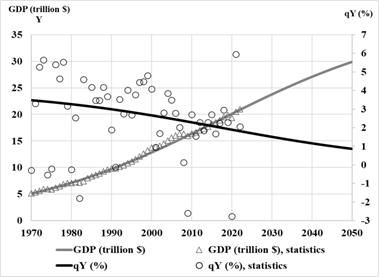

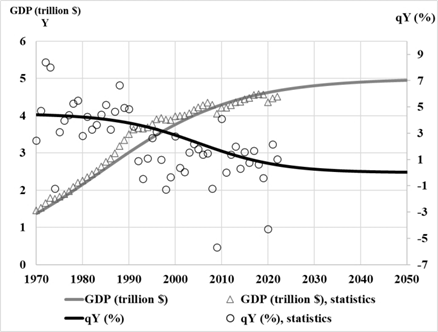

The US demographic dynamics NUSA(t) have been calculated using our model (6), the TP rates have been calculated using model (21) and are presented in Figure 16a. Today they do not exceed 2 % per year and will decline permanently to almost zero by 2050. The economic growth trajectory calculated using formula (5) (shown in Figure 16b) shows that US GDP will reach $30 trillion by 2050, which is about 1.5 times more than the volume of the US GDP in 2020. The growth rate of US GDP is currently about 2 % per year and in the future, it will gradually decline to 1 % per year by 2050.

Fig. 16a. Trajectories of technological progress of the United States

with projections to 2050

Fig. 16b. Trajectories of economic growth (b) of the United States

with projections to 2050

All G7 countries have at different periods borrowed GPT technologies from the United States as the TP leader, so for these countries the model for predicting the pace of the US TP (21) is supplemented by an additional term of type (17). If there are two stages of borrowing, then two terms are added. For example, Japan actively borrowed GPT from the United States in the post-war period, and in the information age it became one of the world's technological leaders. So, the model for predicting the rate of technological change for Japan is written as follows:

.png)

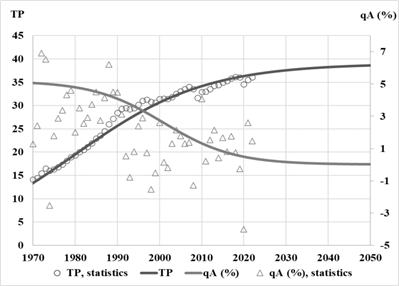

The trend curve describing the dynamics of the TP rate in the Japanese economy is presented in Figure 17a. As we can see from the figure, the projected rates of technological change in the Japanese economy will remain low, falling from around 0.8 % per year today to 0.2 % per year by 2050. Therefore, the projected trajectory of Japanese economic growth, calculated using model (5) and the demographic dynamics calculated using model (6) show the stagnation of the Japanese economy over the next quarter of a century.

a)

b)

Fig. 17. Trajectories of technological progress (a) and economic growth (b)

in Japan with projections to 2050

Comparative Analysis of the Development Dynamics of

the BRICS+ and G7 Countries

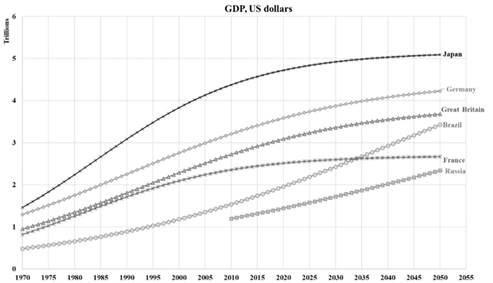

Since we have calculated projected economic growth trajectories for all BRICS and G7 countries up to 2050, as shown in Figures 18 and 19, it is not difficult to make a comparative analysis of them. As can be seen from the graphs in Figure 18, three countries – China, the USA and India – will be the drivers of global economic development until 2050. Moreover, China will become the world's economic leader by 2030, thanks to its steady and continuing rapid growth, and will overtake the United States in terms of GDP by 2028. The United States will continue to grow moderately and maintain its status as the world's second largest economy. Will China be able to sustain high rates of sustainable economic growth after become the world's number one economy in the 2030s and 2040s? Some experts believe that it will not. In 2022, China's GDP per capita was $12,700, exceeding the global average per capita income for the first time. China has thus fallen into a ‘middle-income trap’, and there will be needed serious reforms to escape from it. However, they do not take into account the fact that China is already close to technological sovereignty and has already created the most efficient R&D system in the world, as we already pointed out above.

Fig. 18. Forecast of GDP dynamics of the G7 and BRICS countries to 2050

Fig. 19. Forecast of GDP dynamics of the G7 and BRICS countries to 2050

Indeed, over the past decade, China has relied less and less on borrowed technologies in the industrial sector of its economy and more and more on its own innovations. And in the twenties, China plans to make a transition from the ‘Made in China’ development model to the ‘Innovated in China’ model, which defines a new high consumer quality of Chinese goods based exclusively on Chinese innovations (Wei, Shang-Jin, Zhuan Xie, Xiaobo Zhang 2017). India is the fastest growing of the world's largest countries (see Figure 13). In the coming years, the size of India's economy will exceed that of the leading G7 countries – Germany (2028) and Japan (2030) (see Figure 18). The Indian economy will develop dynamically in the 2030s and 2040s, and by the 2050s it will become equal to the US economy. The remaining leading BRICS and G7 countries will demonstrate moderate growth (Figure 19), and it is quite possible that some of them will move into the second ten world's largest economies, giving way to fast-growing economies from the Global South in the top ten.

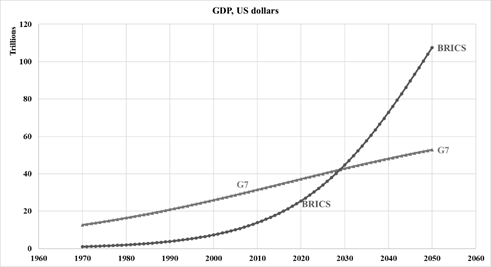

Figure 20 shows the comparison of the economic growth trajectories of two associations – BRICS and G7. We are talking about the dynamics of the movement of the total GDP of the countries of these associations. As can be seen from the figure, the BRICS economy will be on a par with the G7 economy until 2030, and then it will rapidly increase its lead. Let us recall that the BRICS economy overtook the G7 economy in terms of PPP already in 2022, as we wrote about at the beginning of this article. Moreover, as shown in Figure 20, the balance of power will quickly shift in favor of the BRICS. Thus, as Jim O’Neill predicted in 2011 (O’Neill 2013), BRICS will remain the engine of global economic growth until 2050. Moreover, BRICS will become a stabilizer of the global economy, which is currently experiencing instability and uncertainty. This will happen thanks to the sustained dynamic growth of the BRICS leaders – China and India, as well as the gradual active expansion of BRICS+ at the expense of the growing countries of the Global South. The current geo-economic fragmentation of the world, the disintegration of the world into two closed trade and economic blocs around the BRICS+ and the G7, will not prevent the further rise of the BRICS+.

Fig. 20. Forecast of the dynamics of the total GDP of the G7 and BRICS countries