Strategic Regionalism of the Pacific Alliance: An Outlook throughout the Investment

Journal: Journal of Globalization Studies. Volume 15, Number 1 / May 2024

DOI: https://doi.org/10.30884/jogs/2024.01.02

María Esther Morales-Fajardo, CRIM-UNAM, Mexico

The Pacific Alliance (PA) is considered a strategic regionalism in Latin America due to the pragmatic policy trade of the members. One of these pragmatic elements is investment. This article analyzes intra-regional investment flows in the PA in the period 2010–2021 as evidence of strategic regionalism. This article examines the characteristics of the strategic regionalism and the theoretical approaches to foreign direct investment (FDI) from the perspective of capital localization and the internationalization processes of companies. Based on official statistics from the countries, annual FDI and intra-regional investment flows are studied, along with a qualitative analysis of the Pacific Alliance Investment Facilitation Initiative. It concludes that the PA's intra-regional investment is explained by the internationalization and economic importance of multilatina companies, and that it should consider alliances with Chinese enterprises.

Keywords: Pacific Alliance, strategic regionalism, foreign direct investment, intra-regional investment.

Introduction

The Pacific Alliance (PA) was founded with the objective of expanding free trade among Colombia, Chile, Mexico, and Peru, as well as creating an investment trade platform that would insert them into the Asia-Pacific region. The PA was created as a side facet of the Latin American Arch Forum with the objective to carry out actions that could facilitate and promote trade, investment, and the market development between these countries and those of the Asia-Pacific region. However, the urgency of converging trade agreements prompted the PA countries to start negotiations around four themes: trade facilitation, trade integration, the mobility of businesspeople, and cooperation.

The four PA countries signed the Pacific Alliance Presidential Declaration in April 2011. Then the Framework Agreement (FA), the PA's foundational instrument, was signed in 2012, with the objective to set up a free trade area among these countries, with free movement of services, capital, and people – business and migration transit.

The PA is characterized by its intergovernmental organization: The Heads of State are the highest authority, and the Presidency Pro Tempore is the coordinating structure responsible for each country. The Council of Ministers of Trade and Foreign Ministers implements the decisions of the Presidents. The High-Level Panel assesses the progress of technical groups, which are 17 groups dealing with issues of interest to the countries. For the commercial agenda, there are 5 committees and 4 subcommittees dealing with commercial issues.

The PA was created according to the basic elements of the open regionalism of the 1990s: trade liberalization, non-discriminatory export promotion, export promotion, elimination of obstacles to foreign investment. Open regionalism ‘…should contribute to a gradual reduction of intraregional discrimination… to the establishment of suitable payment and trade-promotion mechanisms, to the building of infrastructure and to the harmonization or non-discriminatory application of trade rules, domestic regulations and standards’ (ECLAC 1994: 13). In fact, the PA's Additional Protocol of 2014 formalized 92 per cent of the PA's immediate trade liberalization, the terms of tariff exemptions (3, 7, and even 17 years), and its own elements of open and strategic regionalism, such as rules of origin, trade barriers and facilitation, and cross-border, services, and investment.

In addition, two amending protocols were added to the Additional Protocol (signed in 2015 and 2016). For the purposes of this document, it is interesting to highlight the first, which included a chapter on regulatory improvements, appendices to the chapter on technical barriers to trade, modifications for the telecommunications and e-commerce sector, and the regulation of investment in Chapter 10.

This article focuses its attention on an analysis of intra-regional investment flows in the PA in the 2010–2021 period as evidence of strategic regionalism. Methodologically, this article considers the general characteristics of the strategic regionalism and the theoretical approaches that analyze foreign direct investment (FDI) from the perspective of the macroeconomic determinants of investment, in particular capital localization as well as the internationalization processes of companies, especially those based in Latin American countries and are expanding their activities outside of their economy of residence, which are called multilatina companies. Of course, this is a macroeconomic view that needs to be complemented with an appropriate political analysis in order to understand the governmental and entrepreneurial decisions to localize the capital flows. This study focuses on the investment not only in the global perspective, but also at the regional and sub-regional levels of the capitalist process.

The analysis of capital flows takes into consideration the annual investment outside of Latin America and the PA, the FDI in Latin America and the PA, and, later, emphasizes intra-regional capital flows with data available for the period 2010–2021 from PA members, with the exception of Chile (which provided data from 2012 to 2019 available). The statistical information systematizes the annual FDI flows between the PA countries, based on official statistical sources, in order to know the total FDI of the respective partners of the PA and to determine the investments in the PA, the main investors and the host economies.

The field investigation allowed for an inquiry into the minutes of the Technical Group of Services and Capital (GTSC, in Spanish and now called Investment Subcommittee), which is the institutional authority that is directly linked to the promotion of investment in the PA. A database was built to follow up on the issue of investments and the creation of the Pacific Alliance Investment Facilitation Initiative (IFIAP, in Spanish). Also, semi-structured interviews were conducted with public officials from Mexico and Colombia in order to understand the functioning of this technical group.

In addition to this introduction, the document is structured into three sections. The first section deals with the general characteristics of the strategic regionalism, the second describes the theoretical references for the analysis of FDI and multilatina investment. The empirical part deals with investment in the PA. This is analyzed in order to focus later on intra-regional investment and the promotion of capital flows by means of the IFIAP. Among the main conclusions, it is noted that intra-regional investment in the PA is not the main purpose of the PA, but it is a key element of the continuity of strategic regionalism, and it is explained by the internationalization of multilatina companies and that the IFIAP is in line with the vision of strategic regionalism.

1. Strategic Regionalism: A Brief Outline of the Main Characteristics

In the twenty-first century, new regional schemes were created, but within the framework of the post-hegemonic regionalism, such as the Union of South American Nations (UNASUR) or the Alianza Bolivariana para los pueblos de nuestra América (ALBA).

Briceño (2013) considers that UNASUR was created according to the revisionist regionalism, because the emphasis on social and productive aspects in the regional bloc. In fact, UNASUR's objective is to create a South American integrated space in political, social, economic, and environmental aspects, with the harmonization of policies to promote rural and agri-food development, transfer of technology, horizontal cooperation, and participation of enterprises and civil society.

Meanwhile, ALBA is in line with the anti-systemic regionalism. This regional project began in 2001 as an alternative to the Free Trade Area of the Americas (FTAA), an American proposal. ALBA's objective was to reinforce the self-determination and sovereignty of peoples, and the opposition of the American and international organizations policies (Altmann 2009).

Nevertheless, in the twenty-first century, the PA arose in the new wave of regionalism, but in the logic of the open regionalism of the 1990s. In 2011, the PA members supported similarities in their trade policies (Morales-Fajardo and Cadena-Inostroza 2019) and the political positions of their governments, such as, government elites aligned to the conservative ideology and a position according to the American economic interests. Then, the PA's project followed the neoliberal ideology. The rapid consensus of the four countries was presented as open trade in contrast to the protectionist and national interests of ALBA and UNASUR. In this way, the PA was a revival of open regionalism.

Open regionalism was a strategy adopted by Latin American countries to reintegrate into the global economy, after the debt crisis of the 1980s and with the process of economic liberalization in the 1990s.

In the same trend of market policies, the Economic Commission for Latin America and the Caribbean (ECLAC) advocated the need for trade liberalization, deregulation policies and the promotion of productivity in the national economies and companies in the region (ECLAC 1994).

This type of regionalism is understood as a process driven by market forces and consolidated through integration agreements, which should reflect an increase in both national and foreign investment, an increase in the volume and value added of exports, the incorporation of technological progress into production and the development of sectors with increasing returns (ECLAC 1994). Open regionalism was presented as a part of the neoliberal economic project, under the post-Cold War rearrangement and the discourse of global capitalism.

Open regionalism does not include a comprehensive development perspective, but is limited to economic growth with an emphasis on the generation of production chains. The revival and creation of new integration schemes in the region had a more flexible framework and no forced schedules to comply with, in addition to encouraging foreign investment, the protection of property rights and the competitiveness of companies.

In terms of investment, open regionalism has encouraged foreign capital into the sub-region. Empirical evidence showed that during the period 1991–1999, Latin American countries introduced changes in the laws governing FDI that benefited foreign interests rather than local industry. According to the United Nations Conference on Trade and Development (UNCTAD 2000), 94 per cent of the countries created a favorable framework for capital flows. This was an urgent measure for Latin American economies in order to attract financing for their economic growth, but not for inclusive development.

Trade and investment promotion are key elements of open regionalism, and the evolution towards strategic regionalism is clearly linked to the strategic trade policies of countries. Briceño (2013) points out that this type of regional integration places the essential sectors of the economy as engines of economic development. In strategic regionalism the role of large companies is fundamental: ‘Strategic regionalism is a process resulting from an alliance between nation-states and multinational or national companies that have begun the process of the internationalization of their economic activities’ (Briceño 2013: 20–21).

Strategic regionalism has been seen as a tool to manage the process of economic globalization trough the regionalization of trade and an emphasis on the role of large national and transnational enterprises. These trade policies go beyond free trade to include investment, intellectual property, government purchases, and environmental and labor standards (Lawrence 1999). Perhaps this would make no difference with respect to open regionalism, but, as mentioned above, the cooperation or alliance between companies and the nation-state is the new field: the transcendent role that corporations play in promoting integration agreements (Ibid.).

W. Andrew Axline (1997, 1999) states that, in the case of the United States (the USA), strategic regionalism brings together a number of specific policies that define the nature and direction of regionalism. Sectoral agreements, such as those in the automotive, agricultural, and textile sectors allow for ‘strategic trade management,’ because of which the policy of strategic regionalism includes better access for investors, unconditional protection of property rights, and free circulation of services, all of which are called ‘new disciplines.’

For Björn Hettne (1996), these agreements promote the interests of the members of the blocs. Sometimes they are projects led by both governments and companies that penetrate markets considered protectionist, that is, a strategic alliance. Christian Deblock and Dorval Brunelle (1993) referred to it as an economic policy aimed at establishing a relationship of strength and developing a comparative advantage in international markets.

Therefore, it was not surprising that after the creation of NAFTA, Latin America emphasized the signing of integration agreements to promote free trade, mutual investment, and sectoral agreements. In particular, the PA has been understood as a commercial economic process and a platform for insertion into the Asia-Pacific economies, as was stated in the introduction. As Briceño (2010) points out, there is a commercial bias in the PA where commercial convergence, investment and competitiveness have been privileged. In this sense, there are two outstanding actions to reinforce the entrepreneurial activity: the signing of a cooperation memorandum to create the Latin American Integrated Market and the establishment of joint embassies among the PA members. The first promotes the development of financial markets to reinforce the competitiveness, efficiency, and access to financial markets for investors; and the second one takes advantage of common spaces for consular cooperation, but also stimulates investment in the PA countries. The PA has nine common embassies in Africa, Asia, and Europe.

For the purpose of this paper, investment will be highlighted as part of the strategic trade policy of the PA members and strategic regionalism. The next part refers to the theoretical proposals for investment analysis.

2. Foreign Investment and Multilatina Investment Analytical Approaches

FDI reflects the long-term interest of investors in a foreign economy. Long-term interest expresses the existence of a significant degree of influence in the management of the company that receives this type of investment. Furthermore, it is considered FDI if the investor acquires 10 per cent or more of the shares with voting rights of a company residing in an economy other than its own (OECD 2008; IMF 2009: 100). The components of FDI are new investment, the reinvestment of utilities, and intercompany accounts (IMF 2009).

In this way, the conceptualization of FDI brings together two analytical elements: the localization of capital in a foreign economy and the company. Therefore, its analysis can be carried out from these two fields. The first focuses on the macroeconomic aspects of a country and the factors that influence the investors' decisions to bring their capital to a country other than their own. This type of study, therefore, focuses on studying the conditions of the economy and the impact on, for example, employment.

In particular, the analysis of the localization of capital at the international level can be divided into two trends: those that link it to international trade and those that analyze the market and/or economic processes that encourage FDI. Regarding the former, there are classical models, such as that of Hecksher-Ohlin (which explains the movement of capital by the relative contributions of the factors of the economies); Kojima's theory (1976), considered an update of the classical models of the theory of international trade; and new theories of trade that emphasize the role of economies of scale associated with localization and imperfect markets, as well as the operation of companies in these markets.

The traditional theory of FDI analysis (Dunning 2010) is used to indicate that inward or outward capital flows are related to the economic level and structure of the country. This implies that for an outward investment to take place, the country must have reached a certain minimum level of development, while at the same time having advantages for the evolution of the country's companies.

According to Dunning (2010), investment is related to the level of the intensive knowledge in natural resource-based industries, and that investment is directed towards intensive technological industries and the search for efficiency. Therefore, foreign investment first requires low-technology and natural resource-based industries, in order to later be directed towards higher value-added activities. In other words, it is a structural process that reflects the growth of the national competitiveness of economies.

However, at the beginning of the twenty-first century, statistical evidence from different emerging economies showed the limitations of the theory (UNCTAD 2006). The emerging economies showed different patterns of FDI and outward investment, that is, there was an overlap between the stages of economic growth of these countries and the internationalization processes of their companies. Economies such as Brazil, China, India, Mexico, South Africa, and Turkey were in the initial stages of receiving foreign investment, while at the same time investing abroad.1

The overlap between the stages of internationalization and economic growth would suggest that the firms in these countries do not necessarily have to go through the phases suggested by the traditional literature on FDI. Therefore, it could be expected that government policies, as well as globalization and regionalization processes, particularly trade agreements, would increase the competitiveness and opportunities for local firms in developing countries. It is in this way, then, that processes such as the PA would push local firms to search for internationalization patterns motivated by the free transit of the factors of production, as it is suggested by the strategic regionalism.

A second group of theoretical approaches to FDI focus their analyses on organizations as production units that find incentives not only in macro aspects but also in corporate decisions that drive the internationalization processes of companies. This type of study focuses on discussions about the organizational processes that lead to international activities outside of the country of residence.

Companies are productive units and are the actors that make investments. There are different theoretical approaches to explain their processes of internationalization, such as the Uppsala model, the innovation approach, the product life cycle model, and network approaches (Johanson and Wiedersheim-Paul 1975; Vernon 1966; Alonso and Donoso 1998; Ellis 2000).

Studies of the internationalization processes of companies are derived from the Uppsala Model and the work of Johanson and Vahlne (1977), who established a pattern for the international activities of Swedish companies known as the establishment chain. According to this model, companies begin with export activities and enter into agreements with intermediaries. As their sales grow, companies replace the intermediaries and begin production in foreign markets in order to overcome trade barriers.

Knowledge of the market and psychological distance, which can be understood as the combination of factors that alter the information flows between the company and the market (such as differences in language, culture, political systems, human capital, and industrial development), influence decision making towards riskier investments (Johanson and Vahlne 1977).

Authors such as Canals (1994) and Trujillo et al. (2006) consider the Uppsala Model and combine it with macroeconomic conditions. Canals (1994) states that, along with exports and strategic alliances, a company chooses FDI because of economic forces (the opportunity to exploit economies of scale, improve finances, reduce costs, and take advantage of tariff barriers, infrastructure, and transport), market forces (access to international consumers, distribution channels, convergence of needs, and advertising), and business strategies.

Meanwhile, Trujillo et al. (2006) state that, in addition to the gradual learning by companies, there is a need for full knowledge of the foreign environment (market, industrial structure) and the domestic environment (business strategy), as well as that the internationalization dynamics are conditioned by each industrial sector. For example, some industries are more open to international competition, others tend more towards economies of scale, and still others are slowed down by cost differentials.

According to the UNCTAD (2006), companies in emerging economies find incentives for their internationalization (drivers) in domestic factors (push factors) and factors in the host economy (pull factors). The former are related to the market conditions, production costs, and governmental policies. Companies have a limited market in terms of scale and opportunities for expansion and, therefore, they also find incentives in rapid economic expansion or resource scarcity in their countries, as well as in global and local competitiveness.

The second are more aligned to the traditional determinants of investment attraction, such as the supply of qualified workforce, the proximity to larger markets, the availability of infrastructure and the generation of higher levels of development (Ángeles-Castro and Ortiz-Galindo 2010), and those factors related to the potential of the market, the quality of the factors of production, governmental polities and their effectiveness, and political or labor stability and public safety (Mejía 2005).

According to these internationalization patterns, investment in the PA has been analyzed in the following sections, assuming that FDI is an important element in the economic situations of these countries. Global investment in the PA will be considered in the next analysis, with reference to Chinese investment due to the importance of the Asia-Pacific countries for the PA. Intra-regional investment trends are also considered, as the FA intends to promote capital flows, mainly abroad, but also reciprocal investment.

3. Investment in the Pacific Alliance

In Latin America, and not only for the PA countries, FDI has become an important component of economic functioning through the processes of economic liberalization initiated at the end of the 1980s.

Among the PA member countries, Mexico and Chile are important host economies for investment in Latin America, surpassed only by Brazil. In the period 2010–2021, Chile had an accumulated stock of FDI of $177 billion, equivalent to 9.7 per cent of the total FDI in Latin America. Meanwhile, Mexico accumulated $326 billion, 17.8 per cent of the total of investment received in the region. Over the same period, Colombia received $133 billion (7.8 per cent of the total of FDI) and Peru received $80 billion (equivalent to 4.4 per cent of the investment in the region) (UNCTAD 2020; CEPAL 2020).

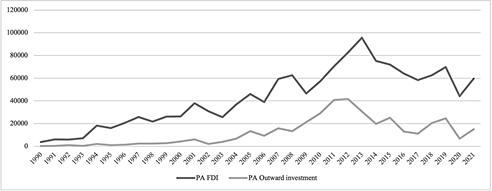

Figure 2 shows the trends in FDI and investment abroad of the PA over the period 1990–2021. Of course, the PA was established in 2011, but it is interesting to observe the tendency of FDI before the creation of this integration bloc. The behavior of FDI in Latin America and in the PA is similar, because the participation of the PA countries in the total FDI in the region, during the 1990–2021 period was 48 per cent. In other words, the four economies of this integration process are important recipients of foreign capital for Latin America.

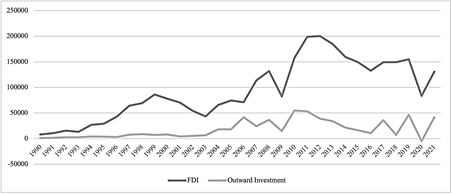

For Latin America, the period 2010–2021 was the most important in terms of receiving FDI. FDI reached a record level of more than $131 billion in 2008 (see Figure 1). Capital flows were motivated by the rise in the commodity prices at the global level, although the services sector stood out due to the benefits granted to productive sectors, followed by manufacturing and raw materials. Particularly, the rise in commodity prices was motivated by sustained Chinese investment, which had grown from 5.5 per cent of the global stock in 2000 to 11.3 per cent in 2019 (CEPAL 2022); in Latin America, Chinese capital flows began to increase since 2004, reaching $ 10 billion in 2010. The second decade of the twenty-first century presented a better dynamism than the previous decade: in 2020, Chinese investment registered more than $16 billion. And 2021 was the best year with $26 billion. China's stock during the period 2010–2021 was USD$ 171 billion (Monitor de la OFDI en ALyC, 2023).

However, the Great Recession slowed down the investment abroad and FDI peaked in 2012 (see Figure 1), when the boom in commodities ended, the value of the dollar became more expensive, and investors' plans were modified due to the fact of the crisis of the Great Recession. Also, in this last phase, investment was stopped – with the exception of China – as a result of the coronavirus pandemic, which is considered a temporary factor because it recovered in the last year with more than $130 billion.

Fig.

1. Foreign investment and outward investment: Latin America, 1990–2021

(USD billions)

Source: Elaborated by author, with data UNCTADstat, 2022.

In the same period, it was also the largest for the PA in absolute terms, receiving an average of $67 billion annually. In relative terms, it accounted for 44.4 per cent of the total FDI in Latin America, compared with 51.7 per cent received in the previous decade. Nevertheless, China's investment in the PA was marginal in comparison with the total investment in Latin America because the PA received only 2.8 per cent of the total investment in the region during the best period of these capital flows (2010–2021). The stock of Chinese investment in PA was $ 4 billion, and Mexico was the economy that benefited most, with a stock of $1 billion (Monitor de la OFDI en ALyC, 2023).

An interesting element that also corresponds to intra-regional investment is the lack of dynamism in 2013, that is after negotiation of the FA. First of all, it could be argued that the formal creation of the PA was not enough of an incentive to continue attracting foreign capital. However, as Figures 1 and 2 show, the decrease of this dynamic is generalized across Latin America and is not a phenomenon unique to the PA. As a platform for insertion into the Asia-Pacific economies, the importance of China's investment for the PA should be noted; although global investment has decreased, Chinese investment has remained dynamic over the last decade.

Fig. 2. PA: FDI and outward investment, 1990–2021

Source: Elaborated by author, with data UNCTADstat, 2022.

The reduction of capital flows both in Latin America and the PA is a response to regional and global factors affecting the investment plans of companies in the region, mainly factors related to the Great Recession of 2008 that affected the investors in developed countries, and the end of the boom in the prices of raw materials. The end of the boom especially benefited South America because investors focused on the search for raw materials, while for Central American countries and Mexico, trade integration with the USA and the search for efficiency were the main reasons for investors (CEPAL 2013).

In the case of the PA, the negotiation of the FA and the guarantees to encourage the movement of factors, especially capital, were included in the basic instrument of this agreement. However, the economic conditions caused by the consequences of the Great Recession and the end of the increase in raw material prices would also affect the reception of investment in this regional bloc.

3.1. Intra-Regional Investment

The proliferation of integration agreements derived from the framework of open regionalism in Latin America has been linked to a component of intra-regional investment. The countries with the greatest economic openness and that continue the postulates of open regionalism – at least in a variable economy, such as the PA – are those that provide for reciprocal investment and, therefore, offer better guarantees to the investor. At the intra-regional level, the increase of agreements has contributed to the creation of a climate that is conducive to investment, and at the same time those agreements encourage the international investment trends (UNCTAD 2000).

Nevertheless, it would be arrogant to claim that regional economic integration is the only incentive for the companies in the region to internationalize. As mentioned earlier, there are many different factors that drive a company to expand its activities abroad.

The integration component and, in the case of the PA, the strategic policy trade would serve as an additional incentive for the companies of these countries to be able to position strategies for the expansion of their activities in each other's markets and to provide for the free transit of factors, mainly associated with exchanges of trade and business people, as well as a clause within the FA that facilitates intra-regional investments.

In this section, empirical evidence is given of intra-regional investment in the PA in order to assess the importance of capital flows in the strategic regionalism.

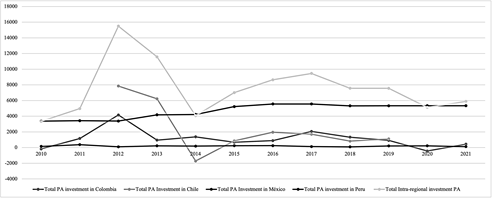

Figure 3 shows the reciprocal investment flows of the PA countries. A first observation is the annual amount received in this regionalism. In the period from 2010 to 2021, the stock of reciprocal investment was $90 billion. It is interesting to observe that this investment is recorded under the heading of foreign investment for each of the economies, so that the stock of this type of investment for the PA countries in the same period was $262 billion. We can therefore conclude that 34.5 per cent of the foreign investment of the PA economies comes from this regional agreement, which would confirm what is proposed by the theory of the internationalization of the multilatinas: Latin American foreign investments continue to be directed towards their own region; in other words, multilatina companies consider the zone as a place to carry out their investment projects.

Fig. 3. PA Intra-regional investment, 2010–2021 (USD billions)

Source: Elaborated by author, with data from the Banco Central de Chile (2021); Banco de la República (2021); Proinversión, 2021; Secretaría de Economía 2021.

Nevertheless, the annual totals of reciprocal investments have tended to decrease since the signing of the FA, as was stated in the final part of the previous section. This would indicate that the multilatina companies of the PA have not found sufficient incentives to expand their internationalization projects in the PA economies, which contributes to the idea that the circulation of capital in the region has not been consolidated. However, it should be noted that this tendency to decrease is coherent with the deceleration of FDI in the Americas and the outward investment of Latin American countries (see Figure 1). But it should also be noted that Chinese investment has shown a contradictory trend as since 2010 these capital flows have increased in Latin America and the PA; even for this bloc, China's investment represented only 2.8 per cent of the total investment in Latin America.

This last point is important to emphasize because, given the original purpose of the PA to serve as a platform for Asia-Pacific economies, China's dynamism should be an incentive for PA economies, to focus on creating opportunities for Chinese firms, even before the multilatinas enterprises.

During the period from 2000 to 2021, Latin American outflows averaged $24 billion per year. However, a comparison of the first two decades of the twenty-first century shows that the second decade was more dynamic than the first. In the first decade, investment outflows averaged $21 billion per year, and in the second decade they averaged $29 billion per year, although a declining dynamic is evident in this period.

Therefore, the expansion plans of multilatina businessmen have also been affected by the economic effects of the Great Recession, the end of the increase in raw material prices, the strengthening of the dollar and, during the 2020, the pandemic conditions, despite the conditions of institutionalization and certainty provided by the legal instruments of the PA.

In the analyzed period, Peru is the economy that has benefited the most from investment by its partners in the PA. This country has received 62 per cent of the investment, followed by Chile (20.7 per cent), Colombia (14.7 per cent), and much less, Mexico (2.5 per cent) (BCC 2021; BanRep 2021; Proinversión 2021; SE 2021). These data contradict what is established by the traditional theory of the determinants of FDI (Dunning 2010), mainly regarding the size of the economy and its competitiveness, since Chile and Mexico are the most attractive countries for investment within the PA, although they have not benefited as much as the Peruvian economy.

However, analyzing the internationalization processes of multilatina companies, the competitiveness of the Peruvian economy would be associated with psychological distance and knowledge of the market that multilatina companies find in order to choose this country (Johanson and Vahlne 1977). In other words, factors such as similarity of culture, language, and consumer habits would be decisive for the multilatinas of the PA to carry out their internationalization processes.

Recall that strategic regionalism provides preferential access to investors and increase benefits for members (Axline 1997, 1999; Hetnne 1996). It has been shown that the share of trade with PA partners as a ratio of total trade was more representative for Peru and Colombia after the creation of the PA (Morales-Fajardo and Cadena-Inostroza 2019). However, this commercial dynamic of both countries is understood by the presence of the Andean Community (CAN) than by the presence of the PA, because the FA allows the use of this instrument among members, but also through bilateral trade agreements.

This indifferent use of the FA or regional agreements is institutionalized in the functioning of the PA and is consistent with the pragmatism of each country's strategic trade policy, according to its needs and convenience.

Chile is the country that has invested the most in the economies of the PA:$43 billion, followed by Colombia with $24 billion, Mexico with $12 billion; and Peru with 9 billion (BCC 2021; BanRep 2021; Proinversión 2021; SE 2021). The first three countries have preferred the Peruvian economy as the main host economy, while Peru has mainly directed its investments to Chile.

Regarding the economic sectors to which the PA's reciprocal investment is directed, of the member states, only Mexico has an itemization of information for members. Chilean investment in the Mexican economy follows FDI patterns, as manufacturing was the sector that received the most capital from this South American country: 47.4 per cent, followed by the commercial sector with 32.4 per cent, agriculture with 13 per cent, and other sectors such as transport and service (real estate, professions and accommodation) with 6.9 per cent. Colombian investment went to the financial services that stood out with 30.5 per cent, followed by manufacturing sector with 29.1 per cent, other activities with 26.2 per cent and construction with 14.2 per cent. Finally, Peruvian investment went to the commercial sector with 40.3 per cent, other activities with 43.7 per cent, accommodation and restaurant services with 12.8 per cent, and manufacturing with 3.2 per cent (SE 2021).2

The panorama of intra-regional investment within the PA shows that Mexico is a country that has invested in this integration bloc, but has not benefited from the investments of those countries. It is understandable that Mexico would be an important investor because the number of global and multilatina companies that have internationalized their activities outside of their country of residence; however, it is noteworthy that the Mexican economy does not represent a transcendent place of investment for investors in the PA.

Among the companies that are present in the region, it must be pointed out that América Móvil (present in Colombia, Chile, and Peru), CEMEX (with facilities in Colombia, Chile, and Peru), FEMSA (with plants in Colombia, Chile, and Peru and with the OXXO chain from Grupo FEMSA), Grupo Bimbo (with investments in Colombia, most recently in Chile, and Peru), and the Chilean Empresas Copec (present in Colombia, Peru, and Mexico) are classified not only as multilatina but also as global companies based in emerging countries, according to their UNCTAD (2020) ranking.

América Móvil is ranked 23rd for its foreign assets and 41st for its position in the Transnational Index.3 CEMEX is ranked 34th and 14th, FEMSA is ranked 53rd and 68th, Grupo Bimbo is ranked 84th and 26th, and Empresas Copec is ranked 95th and 33rd place, respectively (UNCTAD 2020).

The presence of these global companies in the PA economies reflects the economic importance of this mechanism of regional integration in Latin America. It is interesting to note that, even though the annual flows have benefited the Peruvian economy, the recent investment plans of these global companies indicate that Colombia is the destination of their expansion plans. América Móvil has announced that in 2021, $8 billion would be allocated to Colombia, Brazil, and the Dominican Republic (Santiago 2021). Grupo FEMSA inaugurated a soft drinks plant in Colombia at a cost of $250 million (Notimex 2015). Grupo Bimbo announced at the end of 2020 an investment of $17 million to strengthen its production lines in Colombia (González 2020). Grupo COPEC announ-ced, in 2016, the purchase of a lubricant company, Exxon Mobil, split between Colombia and Ecuador (El Economista 2016).

The evidence on the Colombian economy would not necessarily fit in with the traditional determinants of FDI, but it would indicate the psychological distance and market knowledge of the multilatinas in choosing this South American market as a place to expand their activities.

Finally, another relevant fact of the countries in the Pacific Alliance is the number of multilatina companies that have their headquarters in one of these four member countries. According to the ranking of the AmericaEconomía publication (2019), of the 100 multilatina companies, 66 have their main offices one of these four economies: 28 are Mexican, 21 are Chilean, 11 are Colombian, and 6 are Peruvian.

3.2. IFIAP as a Link to Attract Intra-Regional Investment

Until 2021, the Pacific Alliance had 23 Technical Groups within its basic organizational structure. The Technical Groups are the foundation of the organization of this integration mechanism and are made up of officials from these four countries. These groups depend hierarchically on national coordinators, authorities who in turn report to the High Level Group and the Council of Ministers. The highest authority of the PA is the presidents, which means that it is a structure that is more than intergovernmental, but inter-presidential, highly hierarchical, and based on strong leadership and the political affinity (Nolte 2019) among the presidents of these four countries.

However, the specific functioning of the Technical Groups, and in particular, the Technical Group on Services and Capital (GTSC, in Spanish), which was transformed into the Investment Subcommittee in 2021, can be understood through the analysis of the agency network or actor-network theory, as described by some authors (Legler et al. 2018; Morales-Fajardo et al. 2018; Morales-Fajardo 2021). An analysis of the nature, procedures, and functioning of the Technical Groups confirms what Slaughter (2003) observed: they are networks of governmental actors ‘exchanging information, coordinating national policies, and working together to address common problems’ without having to pass through the centralized bureaucracies of formal international institutions. In addition to governmental actors, they also involve in non-governmental and international actors, who establish relationships for the exchange of information and at different levels of intensity, according to their own interests and resources.

Hence, as Legler et al. (2018) note, these actors become the key protagonists in the positions and policies of the PA for the continuity and consolidation of projects, because they monitor the daily progress in the prioritized areas, functions that are normally centralized in a Secretary General who lacks specialists in the areas that are actually considered in the Technical Groups of the PA.

The GTSC was one of the original groups that emerged in parallel to the negotiations on the FA in 2011, with the free movement of capital as an intrinsic element of strategic regionalism and a fundamental pillar for the creation of the PA. The objective of the GTSC was to negotiate everything that affects the FA and the Additional Protocol I. The fundamental purpose of this technical group was to position the PA countries as attractors for investment and trade in services, along with increasing capital and the exchange of intra- and extra-bloc services. In other words, the functioning of the GTSC, under the leadership of the states, was to extend benefits to firms and place these non-state actors in a promoting role for integration (Lawrence 1999).

The case of the topic of investment has been progressive. It is regulated by Chapter 10 of the Additional Protocol I of the FA: ‘The Alliance, through the establishment of the expert in foreign investment Technical Group of Services and Capital [GTSC], must analyze strategies that allow for an increase in foreign investment, not only from an economic and political perspective, but also from a legal vision, responding to the nature of the standards of the integration process… with the objective of avoiding a “double” regulation of foreign investment, which would result in a barrier for increasing the same in the member countries of the Alliance’ (Insignares 2018).

From the evidence collected in the field work, the trajectory of the GTSC between 2011 and 2014 was learned from interviews with public functionaries. The prioritized topics of this technical group were learned from the revision of minutes from 2014 to 2019: cross-border trade, investment, the mixed joint committee,4 statistics on services and investment, and the monitoring of the Latin American Integrated Market (MILA, in Spanish).5 However, between 2014 and 2019, cross-border trade and investment were the topics that were always negotiated in the meetings of the GTSC. Undoubtedly, the topics of the GTSC were in line with the policy of strategic regionalism for a better access for investors (Axline 1997, 1999).

The activities of the working groups were translated into concrete projects. In the case of the GTSC, there was a specific project related to the promotion of intra-regional investment: the Pacific Alliance Investment Facilitation Initiative (IFIAP, in Spanish). The objective of the IFIAP is also evidence of the pragmatism of the strategic regionalism: to increase the intra-regional investment flows in the PA by removing barriers to FDI.

The process of setting up the IFIAP emerged from the negotiations on the restrictions of investments and conflict resolution. The focus of the group is on the first element, and the governments agree that it was necessary to have a diagnosis of the economic and legal bases of the main obstacles to investment. The Inter-American Development Bank (IDB) started this study at the beginning of 2015.

In the same year, Mexico directly requested the support of the World Bank (WB) for analyzing the identification of good practices for foreign investment, while Chile made its own request to the Organization for Economic Co-operation and Development (OECD). In 2017, the WB presented the study on the identification of good practices for attracting FDI.

Following the diagnostic made, the GTSC agreed in September of 2018 to present the IFIAP as an investment facilitation tool, although in March 2019 countries expressed their concerns about the effective implementation, management, and development of this initiative, as well as their uncertainty regarding the support that the World Bank would provide.

Nevertheless, in practice, the implementation of the IFIAP has resulted in the creation of events to promote the initiative and act as a platform for trade facilitation in terms of attracting, retaining, and expanding investment.

In 2018, the ‘First Global Investment Competitiveness Report of the IFIAP’ and the ‘Promotion of Intra-alliance Investors Seminar’ took place. The first occurred in Lima, Peru, with the support of investment promotion agencies from PA countries and the World Bank to promote mutual investments in infrastructure, energy and agribusiness. The second was held in Mexico City and highlighted the importance of the IFIAP as an engine for the growth and expansion of FDI within the bloc.

An important point for the good functioning of the IFIAP is the amount of financial resources available, but in this research, it was not possible to find out the budget for this initiative. However, from the evidence of other projects, such as the Academic and Student Mobility Platform (Morales-Fajardo 2021) and the Cooperation Fund, the capital available for the projects coming from the technical groups is limited, which conditions the functionality and success of the proposals.

Furthermore, because it is an initiative to promote intra-regional investment, and because of the infrequent events that have taken place since its creation, it can be assumed that there is a budgetary constraint on its functioning. In this sense, the work of the GTSC actors is indeed subordinated to the hierarchical chain of the institutionalization of the PA.

Conclusions

Latin America has experimented with several projects of regionalism; in the twenty-first century, some new proposals emerged in specific contexts and according to the interests of the members. The Pacific Alliance was born with the aim of establishing a free trade zone in accordance with the elements of the open regionalism and taking into account the common political vision of their presidents (more oriented towards open trade). Some of the PA's projects have been oriented towards cooperation mechanisms that seem to have exceeded the limits of open regionalism, while the core of this bloc has been created according to the neoliberal interests and global capitalism.

This article has analysed the capital flows that the PA receives, especially intra-regional investments, because they are considered inclusive factors for strategic regionalism and can be articulated with some cooperation measures, like Latin American Integrated Marked or IFIAP.

In the framework of global capital flows, the PA investment rates show similar tendencies with respect to FDI and intra-regional investment, but also with the trends of FDI and outward investment in Latin America, with a clear exception of the dynamism of Chinese capital flows to the region and to the bloc. Even though, the FA does not emphasize in intra-regional flows, but in the investment abroad, China represents a better opportunity to explore larger projects to the economies of this economic bloc, more than multilatinas companies.

For the PA, there was an increase in investment (inward and outward) prior to the negotiations on the bloc, but once the negotiations began, there was less dynamism in attracting both types of investment, with the exception of Chinese investment.

First of all, this would indicate that the conditions established in the FA, and even more so in the case of intra-regional investment, in the Additional Protocol I, did not provide sufficient incentives to continue with this growth trend. However, as established by the theory of the determinants of investment, the conditions of the global economy associated with the economic consequences of the Great Recession, the end of the boom in raw material prices, and the strengthening of the dollar, conditioned the internationalization plans of the investors. These causes were common to Latina America as a whole, and not exclusively for the PA.

Outward investment in PA should be interested in continuing to receive Chinese flows, as it is the best bridge to articulate the platform to Asia Pacific and it is the only global investor that continues with its dynamic trend, in Latin America and PA.

The case of PA intra-regional investment is explained within the framework of internationalization and the economic importance of the multilatina companies of this integration agreement, which would be coherent with the characterization of strategic regionalism that has been attributed to the PA. Nevertheless, it is important to remember that investment will always be a multifactorial component, depending on home and host economies and business strategies.

Due to the importance of Peru as the main host economy for intra-regional investment and Chile as the main investor in the bloc, multilatina investment should consider alliances with Chinese enterprises to make the economies of the PA more attractive and diversify funding sources.

Finally, the analysis of the IFIAP and, more generally, the work of the Technical Group of Services and Capital is consistent with the vision established by the legal instruments of the PA. The joint work of the actors in this technical group has been constant regarding the promotion, movement, and attraction of capital in the PA, as suggested by the strategic regionalism. However, projects such as the IFIAP depend on the availability of budgets, which are determined by the hierarchical chain of command to which the actors of the technical groups answer.

NOTES

* This work was supported by UNAM-PAPIIT IN300223

1 Chinese investment is, perhaps, the most notable case as will be discussed in the next section.

2 Other studies, such as the one by Palacio (2019), point out that, in the case of Peru, in 2016 the investment received by the PA countries went to the agricultural sector with 38.8 per cent, followed by communications with 29.3 per cent and construction with 22.6 per cent.

3 This index takes into account the average ratios of foreign assets to total assets, foreign sales to total sales, and foreign employment to total employment.

4 The Mixed Joint Committee was created with the Memorandum of Understanding in 2011 for the promotion of the trade in services and investment, with the objective that businessmen and investors from the four countries could make suggestions and express difficulties in order to improve the treatment of services and investment.

5 MILA is the integration of the stock exchanges and deposits of the four countries of the Pacific Alliance in order to create a regional market for the negotiation and transaction of the countries' equity securities.

REFERENCES

Alonso, J., and Donoso, V. 1998. La empresa española y los mercados internacionales. Revista De Economía Aplicada VI (17): 189–192.

Altmann B., J. 2009. El ALBA, PetroCaribe y Centroamérica ¿intereses comunes? Revista Nueva Sociedad 219: 127–144.

AméricaEconomía

Intelligence. 2019. Estos son los resultados del Ranking Multilatinas 2019. AméricaEconomía.

URL:

https://www.americaeconomia.com/negociosindustrias/

multilatinas/estos-son-losresultados-del-ranking-multilatinas-2019.

Ángeles Castro, G., and Ortiz Galindo, J. 2010. La inversión extranjera directa en México y su efecto en el crecimiento y la desigualdad económica. Eseconomía V (26): 95–123. URL: https://www.repositoriodigital.ipn.mx/handle/123456789/15560.

Axline, W. 1997. Nafta, Aladi and the Proliferation of Bilateralism in the Americas. Canadian Journal of Latin American and Caribbean Studies 22 (44): 101–126.

Axline, W. 1999. El TLCAN, el Regionalismo Estratégico y las Nuevas Direcciones de la Integración Latinoamericana. In Briceño Ruíz, J. (ed.) Escenarios de la integración regional en las Américas (pp. 11–74). Mérida: Universidad de los Andes.

Banco Central de Chile. 2021. Inversión extranjera directa. URL: http://si3.bcentral.cl/estadisticas/Principal1/Estudios/SE/BDP/ied.html. Accessed in May 2021.

Banco de la República – Colombia. 2021. Inversión directa. Inversión extranjera directa en Colombia. Según país de origen, anual desde 1994. URL: http://www.banrep.gov.co/es/inversion-directa. Accessed in May 2021.

Briceño, J. 2010. La Iniciativa del Arco del Pacífico Latinoamericano. Un nuevo actor en el escenario de la integración regional. Revista Nueva Sociedad 228: 46–59.

Briceño, J. 2013. Ejes y modelos en la etapa actual de la integración económica regional en América Latina. Estudios Internacionales 175: 9–39. URL: http://dx.doi.org/10.5354/0719-3769.2013.27352.

Canals, J. 1994. La Internacionalización de la Empresa. McGraw-Hill.

CEPAL. 2013. La inversión extranjera directa en América Latina y el Caribe 2012. CEPAL.

CEPAL. 2020. La inversión extranjera directa en América Latina y el Caribe 2019. CEPAL.

CEPAL. 2022. La inversión extranjera directa en América Latina y el Caribe 2021. CEPAL.

Deblock, C. Brunelle, D. 1993. Une integration régionale stratégique: le cas nord américain. Revenue Études Internationales XXIV: 595–629.

Dunning, J. 2010. The Eclectic (OLI) Paradigm of International Production: Past, Present and Future. International Journal of Economic Business 8 (12): 173–190. URL: https:// doi.org/https://doi.org/10.1080/13571510110051441.

ECLAC. 1994. Open Regionalism in Latin America and the Caribbean. Economic Integration as a Contribution to Changing Production Patterns with Social Equity. URL: https://re-positorio.cepal.org/bitstream/handle/11362/37868/S9260981_en.pdf?sequence=1.

El Economista. 2016. Copec compra Mobil a Exxon en Colombia, Ecuador y Perú. El Economista. URL: https://www.eleconomista.com.mx/mercados/Copec-compra-Mobil-a-Exxon-en-Colombia-Ecuador-y-Peru-20161.... Accessed November 2016.

Ellis, P. 2000. Social Ties and Foreign Market Entry. Journal of International Business Studies 31 (3): 443–469. URL: https://www.jstor.org/stable/155651.

González, B. 2020. Bimbo tiene proyectado invertir US$17 millones en 2021 para fortalecer la producción. La República. URL: https://www.larepublica.co/empresas/bimbo-tiene-proyectado-invertir-us17-millones-en-2021-para-forta....

Hettne, B. 1996. Development, Security and World Order: A regionalist Approach. The European Journal of Development Research 9 (194): 83–106.

International Monetary Fund. 2009. Balance of Payments and International Investment Position Manual. 6th ed. IMF.

Insignares, S. 2018. Barreras jurídicas a la inversión extranjera en la ‘Alianza del Pacífico’: convergencia de obligaciones internacionales. Ius Et Praxis. 24 (1). URL: https://www.redalyc.org/jatsRepo/197/19758807019/html/index.html.

Johanson, J., and Wiedersheim-Paul, F. 1975. The Internationalization of the Firm – Four Swedish Cases. Journal of Management Studies 12 (3): 305–322. URL: https://doi.org/10.1111/j.1467-6486.1975.tb00514.x.

Johanson, J., and Vahlne, J. 1977. The Internationalization of the firm – A Model of Knowledge Development and Increasing Foreign Market Commitments. Journal of International Business Studies 8 (1): 23–32. URL: https://doi.org/10.1057/palgrave.jibs.8490676.

Kojima, K. 1976. Direct Foreign Investment: A Japanese Model of Multinational Business Operations. London: Croom Helm.

Lawrence, R. 1999. Regionalism, Multilateralism and Deeper Integration: Changing Paradigms for Developing Countries. In: Rodríguez, M., Low, P., and Kotschwar, B. (eds.), Trade Rules in the Making: Challenges in Regional and Multilateral Negotiations (pp. 23–46). Washington, D.C.: OAS and Brookings Institution Press.

Legler, T., Garelli-Ríos, O., and González, P. 2018. La Alianza del Pacífico: un actor regional en construcción. In Adenaur Stiftung, K. (ed) La Alianza del Pacífico: ¿Atrapada en el péndulo del regionalismo y del interregionalismo? (pp. 143–172).

Mejía, P. 2005. La inversión extranjera directa en los estados de México: Evolución reciente y retos futuros. Economía, Sociedad y Territorio: 185–236. URL: https://www.redalyc.org/articulo.oa?id=11109907.

Monitor de la OFDI en AlyC. 2023. China's Foreign Direct Investment to the World (2004–2021) México. URL: https://www.redalc-china.org/monitor/.

Morales-Fajardo, M. E., and Cadena-Inostroza, C. 2019. Mexico in the Pacific Alliance: A Comfortable Position. Tamkang Journal of International Affairs 23 (1): 1–70.

Morales-Fajardo, M. E., Cadena-Inostroza, C., & Retana-Enríquez, A. I. 2018. Redes de actores: el grupo técnico de cooperación y la plataforma de movilidad de la alianza del pacífico. Revista del centro de graduados e investigación 33 (75): 57–63.

Morales-Fajardo, M. E. 2021. Redes de actors en la Alianza del Pacífico. El Grupo Técnico de Cooperación y la Plataforma de movilidad. In Morales-Fajardo, M. E. and Cadena-Inostroza, C. (eds.) ¿Redes o gobernanza? Experiencias de colaboración entre actors. Cuernavaca: CRIM-UNAM.

Nolte, D. 2019. Lo bueno, lo malo, lo feo – y lo necesario: Pasado, presente y futuro del regionalismo latinoamericano. Revista Uruguaya De Ciencia Política 28 (1): 131–156. URL: https://doi.org/10.26851/rucp.28.1.5.

Notimex. 2015. Coca-Cola Femsa abre en Bogotá la planta más moderna de AL. El Financiero, URL: https://www.elfinanciero.com.mx/empresas/coca-cola-femsa-abre-en-bogota-la-planta-mas-moderna-de-al-....

OECD – Organization for Economic Co-operation and Development. 2008. OECD Benchmark Definition of Foreign Direct Investment. 4th ed. OECD.

Palacio, A. 2019. Marcos regulatorios de servicios e inversiones en la Alianza del Pacífico y Mercosur. ¿Convergencia a normas del siglo XXI? (Ser. 143). URL: https://repositorio.cepal.org/bitstream/handle/11362/44790/1/S1900630_es.pdf.

Proinversión. 2021. Inversión Extranjera. Saldo de Inversión extranjera directa por país de domicilio. URL: https://www.proinversion.gob.pe/modulos/jer/PlantillaPopUp.aspx?ARE=0&FL=0&JER=5975. Accessed in May 2021.

Santiago, J. 2021. América Móvil anuncia inversión de 8,000 mdd. El Economista. URL: https://www.eleconomista.com.mx/mercados/America-Movil-anuncia-inversion-de8000-mdd-20210210-0113.ht....

Secretaría de Economía. 2021. Inversión Extranjera Directa Información trimestral por flujos totales de IED haca México por países de origen, según tipo de inversión, sector económico o entidad federativa. URL: http://www.gob.mx/se/accionesyprogramas/competitividad-y-normatividad-inversion-extranjeradirecta?st.... Accessed in June 2021.

Slaughter, A. 2003. Global Government Networks, Global Information Agencies, and Disaggregated Democracy. Michigan Journal of International Law 24 (4): 1041–1075. URL: https://doi.org/10.2139/ssrn.283976.

Trujillo, M., Rodríguez, D., Guzmán, A., and Becerra, G. 2006. Perspectivas teóricas sobre internacionalización de empresas. In Documentos de Investigación. 30th ed. Universidad del Rosario, Fac. de Administración.

UNCTAD. 2000. World Investment Report 2000 Cross-border Mergers and Acquisitions and Development. Switzerland, United Nations Conference on Trade and Development. URL: https://unctad.org/webflyer/world investment-report-2000.

UNCTAD. 2006. World Investment Report 2006. FDI from Developing and Transition Economies: Implications for Development. New York and Geneva, United Nations Conference on Trade and Development. URL: https://unctad.org/system/files/officialdocument/wir2006_en.pdf.

UNCTAD, 2020. World Investment Report 2021. Investing in Sustainable Recovery. New York: United Nations Conference on Trade and Development UNCTAD/WIR/2021.

UNCTADstat. 2022. Foreign Direct Investment: Inward and Outward Flows and Stock, Annual. URL: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx.

Vernon, R. 1966. International Investment and International Trade in the Product Cycle. The Quarterly Journal of Economics 80 (2): 190–207. URL: https://doi.org/10.2307/1880689&isAllowed=y.